Alcoa flags 'pretty aggressive' cost cuts at alumina refineries

Alcoa chief executive Bill Oplinger told Wall Street the US aluminium specialist could take strong action to boost profits from alumina, most of which it refines in Western Australia.

Rising gas prices resulting in job losses are inevitable unless the WA government mandates more supply from gas exporters.

ANALYSIS

Australia's most gas-rich and gas-dependent state faces a severe shortage of the fuel in the next decade, according to the Australian Energy Market Operator (AEMO).

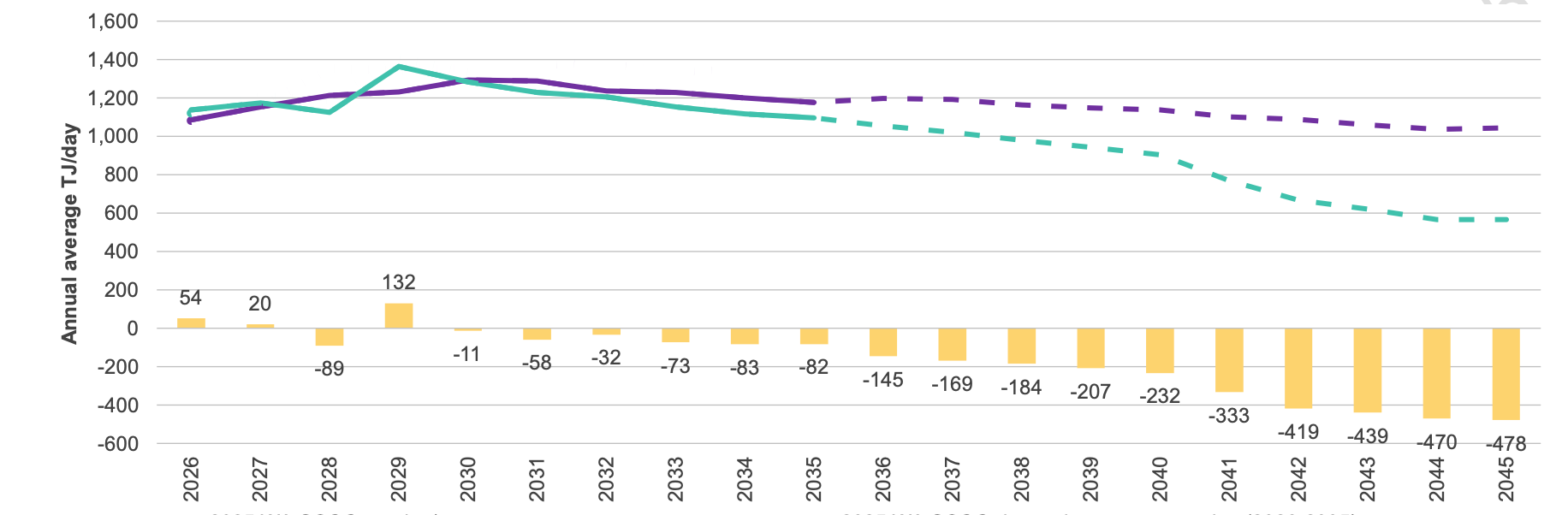

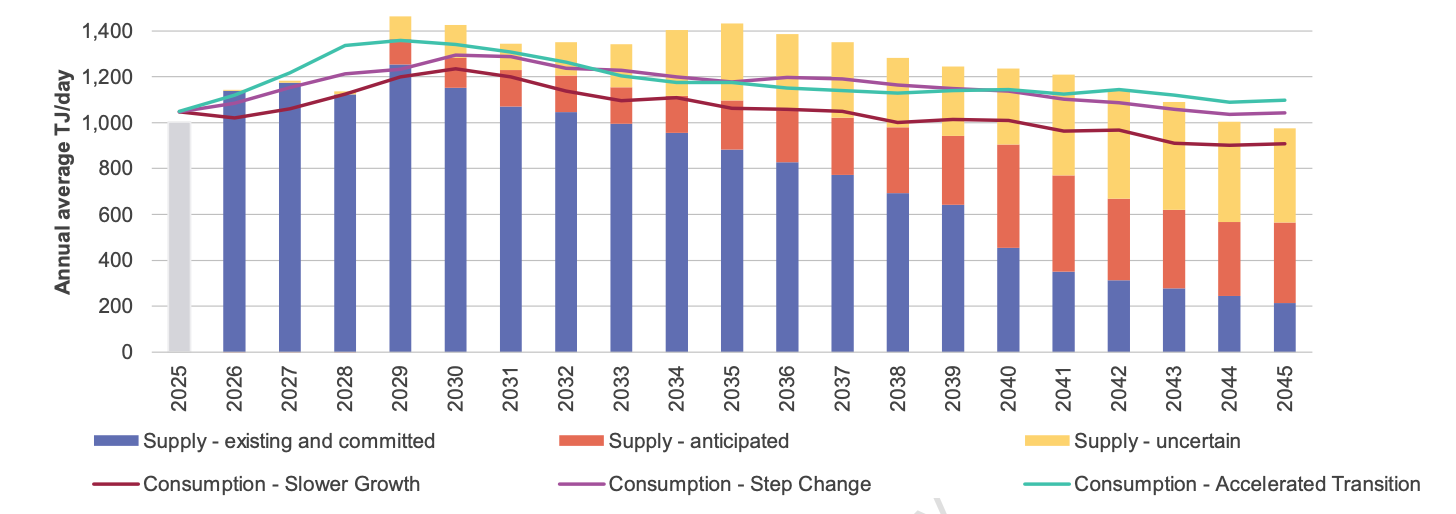

WA is expected to be short of gas from 2030 with the shortfall reaching an enormous 45 per cent of demand in 2045, according to AEMO's 2025 WA Gas Statement of Opportunities released on Friday.

AEMO manager for WA Kirsten Rose said the market would be broadly balanced this decade.

However, AEMO predict the market will be severely undersupplied in the 2030s and beyond.

“A combination of solutions, including the continued investment in new gas developments, alongside increased supply flexibility, could address potential longer-term shortfall risks,” Rose said.

Those measures could fix the shortfall, but the odds are long.

Mia Davies, spokeswoman for the Domgas Alliance of large WA gas users was more forthright:

"Under every scenario modelled by AEMO, we are facing a structural shortfall of gas for domestic use that only worsens as the years go by," she said.

"If planned Perth Basin projects don’t deliver as modelled, which you have to think there is a reasonable likelihood of occurring, the shortfall could be upon us sooner,

"That is likely to mean is higher energy prices for consumers, increased volatility as the state transitions from coal-fired power, a risk that new investment goes interstate or offshore and job losses in industries that rely on affordable and reliable gas for their viability."

Here are some key takeaways about the fuel that just eight years ago WA governments thought would be cheap and plentiful for decades:

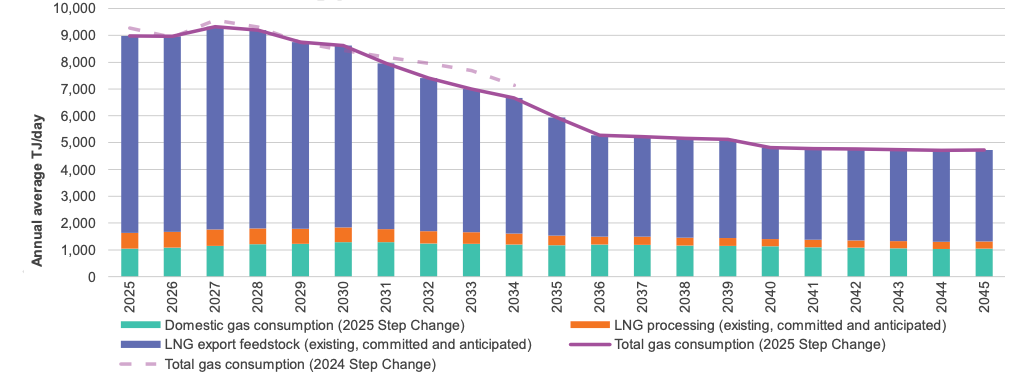

WA's gas exporters consume more than eight times the amount of gas than all local industry and consumers combined.

Piers Verstegen, an analyst at Climate Analytics, said exporters have delivered to the local market gas equivalent to just eight per cent of exports, only about half the 15 per cent targeted by long standing WA government policy.

Verstegen calculated that if the 15 per cent target was met there would be no shortage of gas until at least 2034. Further, if the shorfall of the past four years was made good the market would be well supplied until the early 2040s.

WA is not short of gas. It is simply letting too much be exported

In the five years from 2019, the average wholesale price in WA more than doubled to $7.27/GJ.

The trend will only continue as the market tightens and customers who have no alternative to gas - which is many of them - compete to secure supply.

Eventually something has to give...

It is only two sentences in the report, but they pack a punch:

Gas price-sensitive industries may reduce or cease operations if gas or alternatives are not available at competitive prices ... this could occur from approximately $10.00/GJ.

With the market tightening $10 will not be far away.

Note that $10 was the median price that companies surveyed said would hurt them, so half the surveyed firms are in strife at a lower price.

Industry also said they are likely to expand oparations at a gas price of about $4.30.GJ. That price will never be offered in WA again.

The survey respondents are companies with substantial sunk costs.

Potential new investors with significant capital expenditure ahead of them and alternative investment locations which will be much more sensitive to gas prices.

The scale of the economic damage will not just be the jobs lost, but the unknown amount of jobs that are never created.

The destruction of manufacturing that LNG exports have inflicted on the east coast is coming west.

AEMO's base case supply forecast, as worrying as it is, is unrealistically high.

Chevron's Gorgon project is the biggest supplier of gas to WA, and AEMO gas assumed that it will continue, with 274 TJ/day flowing for 20 years.

That confidence has no basis in commercial reality.

Chevron and its Gorgon partners - ExxonMobil, Shell and a sliver of Japanese utilities - do not have an obligation to reserve gas for the domestic market equal to 15 per cent of exports.

Instead, the 2003 Barrow Island Act passed by a former Labor Government, required 2000 petajoules of gas to be set aside.

This accounted for approximately 15 per cent of the then-planned gas exports, but by the time Gorgon went ahead six years later, the known reserves were much greater, and the project had grown to three export trains.

The multinationals had a much bigger pie, but WA's slice remained the same size.

Effectively, Gorgon has a domestic gas obligation of about seven per cent, which will be fulfilled in about 2037.

The only reason Gorgon's partners will sell gas without an obligation is if it is as profitable exports.

If that happens it means the WA gas price is linked to LNG, and the beneficial effects of WA gas reservation policy is no more.

Gorgon supply after 2000 petajoules are delivered should not be in AEMO's base case. Accepting assurances from government and industry that all will be well is simply naive.

AEMO's base case gas supply comes from fields that are producing now and "anticipated" projects with a high likelihood of being developed.

Two anticipated projects AEMO counts on have not yet reached final investment decision:

And for demand to be met a lot of projects deemed uncertain by AEMO must go ahead.

The "uncertain" new projects are:

For Browse, remember Shell got out as it was an expensive, highly polluting, low retrm investment. And Equus, well Hess sold it for $US2 for a reason.

There is no shining white knight on the horizon to solve the problem, the days of cheap and plentiful gas in WA are over.

There was more bad news for gas consumers this week.

On Thursday, WA's Economic Regulation Authority (ERA) greenlit an enormous 33 per cent hike in the cost of transporting gas from the Pilbara to the South West through the Dampier to Bunbury Natural Gas Pipeline (DBNGP).

The "T1 Tariff" is now $1.82/GJ, up from the $1.37/GJ set five years ago.

The move has the same effect on industry in the South West as a gas price hike - it pushes them closer to economic trouble.

Many large industrial and power generation users take their gas direct from the DBNGP.

Gas to other customers in the Mid-West and South-West travels from the DBNGP through the network owned by Canadian firm ATCO.

A year ago the ERA approved a 33 per cent increase in ATCO's tariff.

On every front, gas it getting more expensive.

The WA economy will transform because of this, and it will be painful for some sectors of the economy.

State government policy can determine where the hurt lands.

Like their Federal counterparts, to date they have favoured gas exporters over local manufacturing and power generation.

A gas shortage. higher prices, and an economic knock are inevitable in WA unless the state government mandates more local gas supply from export projects.

2025 Western Australia Gas Statement of Opportunities: December 2025

2025 Western Australia Gas Statement of Opportunities: Appendices December 2025

All the info and a bit of comment on WA energy, industry and climate every Friday