Alcoa to own just 5pc of WA plant to bust China’s dominance of gallium supply

The US miner under fire for its environmental performance in WA sees the gallium plant solidifying the importance of its Wagerup alumina refinery.

The US miner under fire for its environmental performance in WA sees the gallium plant solidifying the importance of its Wagerup alumina refinery.

Alcoa will own just five per cent of the gallium plant in WA that the US miner sees as solidifying the importance of its Wagerup alumina refinery.

Alcoa chief executive Bill Oplinger said the idea for a plant to extract the critical mineral gallium from the bauxite Alcoa mines in WA began with the company and Japanese interests, and “a number of months” ago it started talking with the Australian and US governments.

“The really critically important thing here is to have a supply chain of gallium outside of China and this is what the governments want,” he told Wall Street analysts on Thursday Perth time.

China currently produces about 98 per cent of the global supply of gallium that is used crucial for high-speed semiconductors and LEDs and is also used in solar panels and high-performance electronic devices used by the military.

About 700 tonnes of gallium was used in 2023 and demand is expected to near 1200 tonnes by 2023.

“It really strengthens the relationship between … President Trump and Prime Minister Albanese, strengthens the relationship between the US, Australia, Japan, and really shows the importance of Alcoa in Australia,” Oplinger said.

The 100 tonnes a year plant will be owned by Japan Australia Gallium Associates, a joint venture between the Japan Organization for Metals and Energy Security and Sojitz, and a special purpose vehicle (SPV) for the interests of Alcoa and the Australian and US governments.

Oplinger said the Japanese joint venture and the SPV will each own half the plant and all parties will take gallium production in proportion to their ownership, with Alcoa receiving about five tonnes a year.

“We still have to get through definitive agreement, so we're making these comments based on the memorandum of understanding that was signed,” he said.

“This is not a large plant; it is not a large investment.”

The deal is a fillip for Alcoa is WA where it sources more than 70 per cent of its bauxite and alumina but has seen its social license crumble in recent years over environmental concerns.

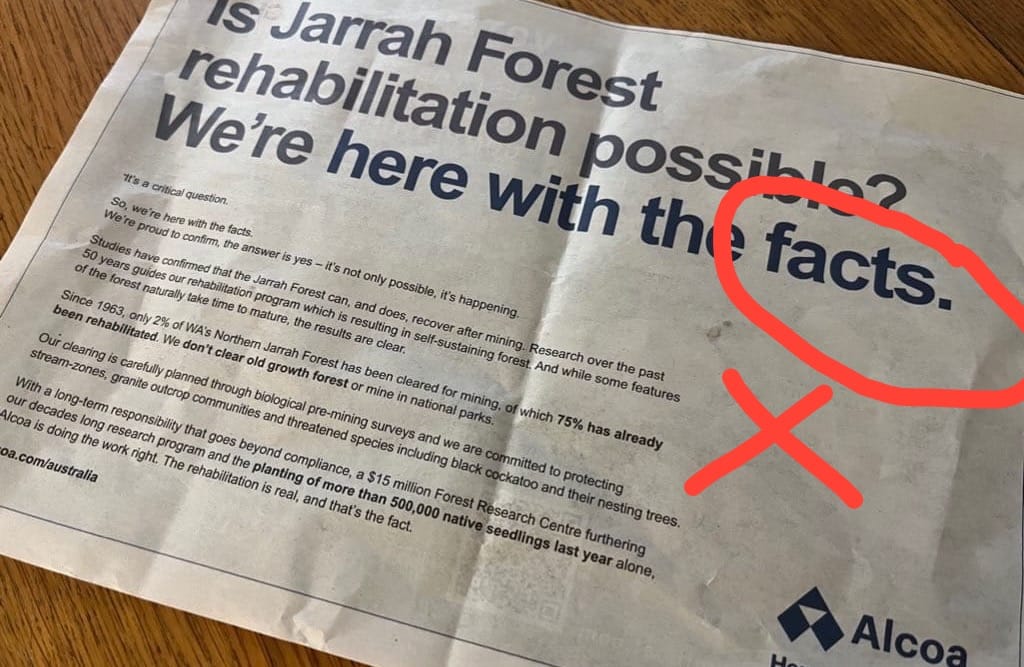

After more than 60 years of mining it is yet to fully rehabilitate a single hectare of the 280 squire kilometres of jarrah forest it has strip mined and was found to be advertising “misleading or deceptive” claims about its rehabilitation.

There are also concerns that its mining could contaminate Perth’s water supply. A study commissioned by Alcoa found that out of 22 different ways its mining could contaminate drinking water dams, all but one of them presented a high risk.

The threat to the water supply mainly comes from Alcoa’s Huntly mine that feeds bauxite to its Pinjarra alumina refinery. The Wagerup refinery further south is supplied by the Willowdale mine.

WA’s independent Environmental Protection Authority (EPA) is assessing an expansion of the Huntly mine and current mining at both sites.

Olplinger said the plant “solidifies the importance” of the Wagerup refinery.

Any recommendation by the EPA to restrict mining at Willowdale could now possibly be rejected by the WA government on strategic grounds.

“The continuity and competitiveness of Alcoa's Australian mining and refining operations not only support the aluminium industry, but also support manufacturing technology and defence industries,” Oplinger said.

Oplinger said Alcoa had “an aggressive schedule” to be producing gallium by the end of 2026.

He is right.

Whilst Oplinger says it is not a large plant, the Australian Government’s commitment of $US200 million ($308 million) for its yet to be disclosed share of the 45 per cent to be held by it and the US Government indicates it is a facility of some size and complexity.

It is also in the early stages of technical development with Alcoa currently studying the feasibility of using ion exchange technology to extract gallium from the process stream of the alumina refinery, according to a company spokesman.

For Alcoa to meet the end of 2026 target it has 14 months to complete the feasibility study, conduct detailed design, appoints a construction contractor, build the plant and then commission it.

Oplinger said one reason the Wagerup refinery was chosen to house the plant instead of the larger Pinjarra refinery was that there “we have line of sight to get the approvals done fairly quickly.”

WA Premier Roger Cook, in a response to a question in Parliament this week, said the gallium plant would require an approval under Part V of Environmental Protection Act which would assess its emissions and discharges.

This would entail obtaining a works approval from the Department of Water and Environmental Regulation which is a much shorter process than an assessment by the independent EPA.

Until Alcoa receives approval to expand its Huntly mine north Serpentine Dam, Perth’s largest, it is supplying low grade ore to its Pinjarra refinery.

“This is bauxite that we would have typically thrown away in the past,” Oplinger said.

The Pittsburgh-based executive said he expected the EPA to publish its recommendations by mid-2026 and for the WA environment minister to approve the expansion by the end of that year.

In September Alcoa announced the permanent closure of its Kwinana alumina refinery, its oldest in WA, with decommissioning estimated to cost $US600 million ($923 million).

The refinery’s legacy includes an enormous 141 million cubic metre stockpile of toxic bauxite residue piled as high as 77m.

Alcoa chief financial officer Molly Beerman said the task of managing water at the residue site was the largest the company had ever experienced and was a big contributor to the total clean up cost.

Beerman said Alcoa thought the refinery site that has port and rail access would be “quite valuable.”

“We will focus on remediating the refinery site and preparing that for redevelopment and resale to try to get a full recovery of those closure costs and possibly exceed it,” she said.

All the info and a bit of comment on WA energy, industry and climate every Friday