Gas seeping to surface from Chevron's Barrow Island oil operation

The WA environment regulator is investigating unknown amounts of hydrocarbons rising to the surface on the Class A nature reserve.

Woodside is now chasing investors in its $US12B Scarborough to Pluto LNG project, but they need to look beyond the headline number.

ANALYSIS

Woodside has revised the cost of its make-or-break Scarborough LNG project up by a less than expected five per cent to $US12 billion ($16 billion), but investors should be cautious about who wears the risk if the costs blow out.

And costs always blow out.

Woodside aims to sanction by year-end its Scarborough to Pluto LNG project to replace declining production from the North West Shelf project, and later this decade from its Pluto field.

Gas from the Scarborough field, 26.5 per cent owned by BHP, is to be piped 430km to the Burrup Peninsula where it will be liquified for export in a new LNG train to be built at Woodside's Pluto LNG plant.

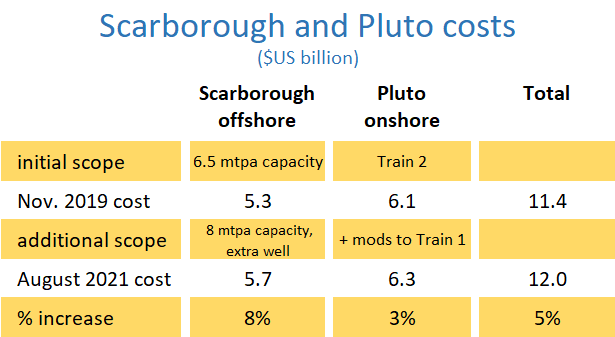

Woodside acting chief executive Meg O’Neill yesterday said the $US600 million cost increase included a 20 per cent increase in offshore processing capacity and modifications to Pluto LNG Train 1 to allow it to process more gas from Scarborough.

When then chief executive Peter Coleman presented the previous Scarborough to Pluto cost of $US11.4 billion in November 2019 the company planned to export 6.5 million tonnes a year of LNG made from Scarborough gas.

A new LNG train at Pluto could process 5 mtpa and Woodside would use 1.5 mtpa of spare capacity at the nearby North West Shelf LNG plant until it filled with gas for the distant Browse project.

Since then Woodside's design has increased production from Scarborough and put a greater focus on processing additional gas through Pluto Train 1.

Containing the cost increase to five per cent is impressive in the circumstances: the scope has increased significantly, there are severe labour shortages in the Pilbara, and the price of a barrel of Brent crude is now $US75, compared to $US63 in November 2019.

O'Neill said the new costs reflected refreshed pricing from major contractors and "Woodside’s work with them since 2020 to maximise the value of the project by optimising design and execution planning."

Woodside shareholders, BHP and any investors looking to buy into Scarborough or Pluto Train 2 will want to be confident that Woodside can build the project for the new $12 billion budget.

Any number of factors can cause a project to go over budget. The late delivery of just one critical item can throw the entire schedule into disarray, as can a shortage of workers. Any poor quality work in the factory or on-site can require extensive rework. COVID presents additional risks.

However, perhaps the biggest cause of a project costing more than the estimate is an unrealistic overly optimistic estimate in the first place from a team or company committed to seeing a project go ahead.

Most oil and gas projects are joint ventures and cost estimates receive a level of independent assessment from the non-operating partners.

In this case, Pluto Train 2 is 100 per cent Woodside so no other company has looked at the work.

Within the confidentiality of the operator, the cost estimate is not just the published headline number but a detailed assessment that produces a range of cost outcomes with different probabilities.

The most commonly quoted are the P50 cost with an equal chance of being more than or less than the eventual cost, and the high P90 cost estimate with only a 10 per cent chance of being exceeded. There is also a low P10 cost estimate.

The final cost of a project should fall between the P10 and P90 estimates 80 per cent of the time.

If the P10 and P90 estimates are close then the project cost has a low risk. Conversely, if the P90 estimate is a lot higher than the P50 estimate there is a 10 per cent chance of a truly value-destroying outcome.

It is odd that so much importance is placed on a single published number when the reality is so complex.

Woodside is no different to other companies in wrapping up years of work by hundreds of people into, in this case, six key strokes: $US12B.

Companies often do not state whether the published number is the P50 value, but everyone assumes that is the case.

One oil and gas company with a big presence in Perth, but not Woodside, once hid an increase in a P50 cost estimate by publishing the new P40 value. No one was the wiser that apples had been compared to oranges.

So a cost has a published number, normally the P50, and an element of risk or variation.

The third area of cost an investor should look at is how that cost risk is shared. Who suffers if the project does not go to plan?

O'Neill's mentioned cost risk in yesterday's statement to the ASX.

“Woodside’s contracting strategy for Scarborough reduces cost risk, with approximately 90% of total project contractor spend structured as lump-sum and fixed-rate agreements," O'Neill said.

A crucial point in negotiations between Woodside and its contractors, Bechtel for Pluto Train 2 for example, is how the risk of cost overruns is allocated.

In November 2019 Woodside detailed how most of the burden of any increased costs would fall on the contractors.

Lump sum, or fixed-price, contracts covered 79 per cent of the scope and a further 8 per cent of the estimate was so-called provisional sums, that would be translated into lump sums within 12 months of contract award when more information was available. The remaining 13 per cent of the scope was covered by unit rate or frame agreements.

On the basis that major companies carefully craft, review and polish every word in important releases to the ASX, the difference in how cost risk is described in the latest announcement is revealing.

Now 90 per cent of the scope is lump-sum and fixed-rate agreements, not 100 per cent. There is no detail about how much of that 90 per cent is the much safer (for Woodside) lump sum agreement instead of fixed rates, and how much of the scope "structured as lump-sum...agreement" is actually provisional sums yet to be fixed.

Boiling Cold asked Woodside to provide a percentage breakdown of today's costs between lump sum, provisional sum, and fixed or unit rates, as it did in 2019.

Woodside was also asked if the cost assumes when Pluto Train 2 starts needing significant numbers of workers that COVID restrictions on interstate and international movement of workers could still be in place.

Woodside did not respond.

"We have commenced the formal processes for selling down our interest in Pluto Train 2 and Scarborough as we target the investment decision later this year," O'Neill said yesterday.

"And these processes are supported by the updated cost estimate.”

Caveat emptor.

Cost talk

Main image: Graphic of the Scarborough and Pluto Train 2 LNG project. Source: Woodside Energy Limited.

All the info and a bit of comment on WA energy and climate every Friday