🗡️ Who murdered the Murujuga rock art science?

Special Cluedo™️ edition 🔍 Was it Mr Cook or Prof Smith?

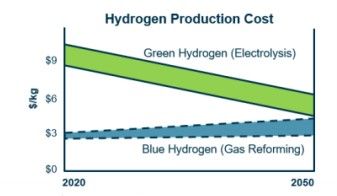

In a decade hydrogen made with renewable power may be cheaper than making it from gas and offsetting the emissions according to an independent expert analysis but Woodside thinks gas has 30 years left.

Hydrogen made with renewable energy could be cheaper than so-called blue hydrogen from gas before the end of the decade, blowing a hole in the case to invest in blue hydrogen production.

Wood Mackenzie Asia Pacific head of energy transition research Prakash Sharma said technical improvements and increasing scale could make green hydrogen competitive by 2030.

Future demand for hydrogen is based on its ability to provide emissions-free energy where grid electricity or batteries cannot, such as steelmaking and long-distance transport.

The fuel can be green hydrogen made by electrolysers powered by renewable energy that separate hydrogen from water.

The alternative is blue hydrogen made by the long-established technology of steam methane reforming that separates natural gas into hydrogen and carbon dioxide. The CO2 is then either buried or its global warming effect offset by measures like tree planting.

Sharma told an Australian Institute of Energy webinar yesterday that the standardisation of electrolysers, improvements in their efficiency and continued reductions in the cost of renewable would drive the price of green hydrogen down.

“In the case of Australia, with its large solar and wind potential, we think we can get to that pathway by 2030 or even earlier,” Sharma said.

Woodside executive vice president sustainability Shaun Gregory presented a timeline in October 2019 that showed blue hydrogen would be competitive for three times as long as the Wood Mackenzie view.

“Australia has ample potential sources of renewable power, but there is still a long way to go before those sources are developed to a scale to support mass green hydrogen production for export,” Gregory told a national energy summit.

If WA gas giant Woodside’s hydrogen strategy is based on using gas to make blue hydrogen until 2050 and the process is uncompetitive by 2030, as predicted by Wood Mackenzie, then a decade and many billions of dollars could be wasted.

Blue hydrogen production until 2050 tallies well with Woodside’s view that it can produce unlimited emissions from its LNG plants until 2050 when the Paris Agreement requires net-zero emissions. This approach is contrary to the science that a gradual reduction in emissions over the next three decades is required to limit global warning sufficiently.

Gregory doubted that wind and solar power could be deployed at sufficient scale to support large-scale hydrogen production.

“To date, renewable energy has been solely for domestic use – if it is also to support hydrogen exports, we’ll need to build extra capacity dedicated to that purpose,” Gregory said.

“In addition, there could be challenges such as land access rights, transmission lines, or climate change impacting weather conditions that underpin renewable power.”

The Asian Renewable Energy Hub is working through all those problems just five hours up the road from Woodside’s LNG plants near Karratha and plans to export its first clean power in 2027.

Oil and gas major BP has launched a feasibility study to make enough green hydrogen near Geraldton to make one million tonnes of ammonia a year.

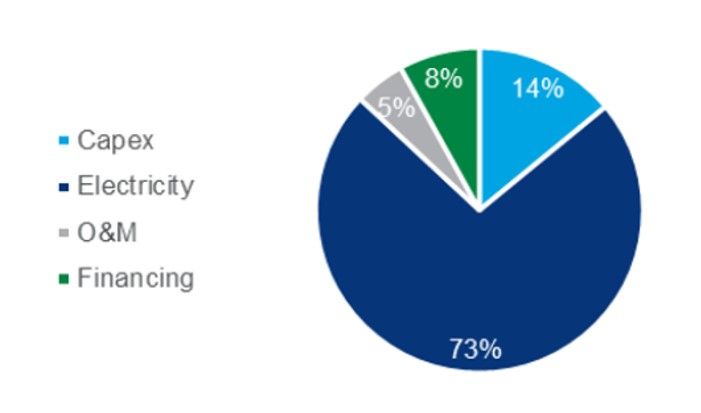

Electricity makes up almost three-quarters of the cost of green hydrogen, according to Wood Mackenzie.

Manufacturing at massive scale with continual efficiency improvements has allowed the price of first solar power, then wind power and now battery storage to drop each and every year, exceeding most forecasts.

That same effect is possible with electrolysers as they are standard units in a factory, but scale will be required.

Green hydrogen made with purchased renewable power is a low capital cost but high operating cost business. This allows electrolysers to be run at much less than full capacity if the power is cheap enough.

Sharma said the cheapest green hydrogen could come from electrolysers used for just 50 to 60 per cent of the time.

At Woodside’s annual general meeting earlier this month Woodside chief executive Peter Coleman said he was concerned about investing in rapidly improving technologies like solar energy as investments can have marginally higher costs than competing projects that follow.

The bigger danger might be to invest in blue hydrogen.

Steam methane reforming is a stable technology with little prospect of cost reduction. Carbon storage underground is a large infrequent investment so has a slow learning curve made worse by geology making each application unique.

As the old saying goes, to a man with a hammer every problem looks like a nail.

Perhaps a company with gas has a similar singular focus.

Main picture: North West Shelf LNG plant, Karratha. Source: Woodside Energy Limited.

All the info and a bit of comment on WA energy and climate every Friday