Is Black Mountain's Kimberley dream fracking impossible?

Investors beware: after spending more than $40 million in the Canning Basin, the US-owned company's continued pursuit of remote gas appears to be throwing good money after bad.

Pilot Energy is a going concern, but its accounts report "a material uncertainty which may cast significant doubt" on that continuing.

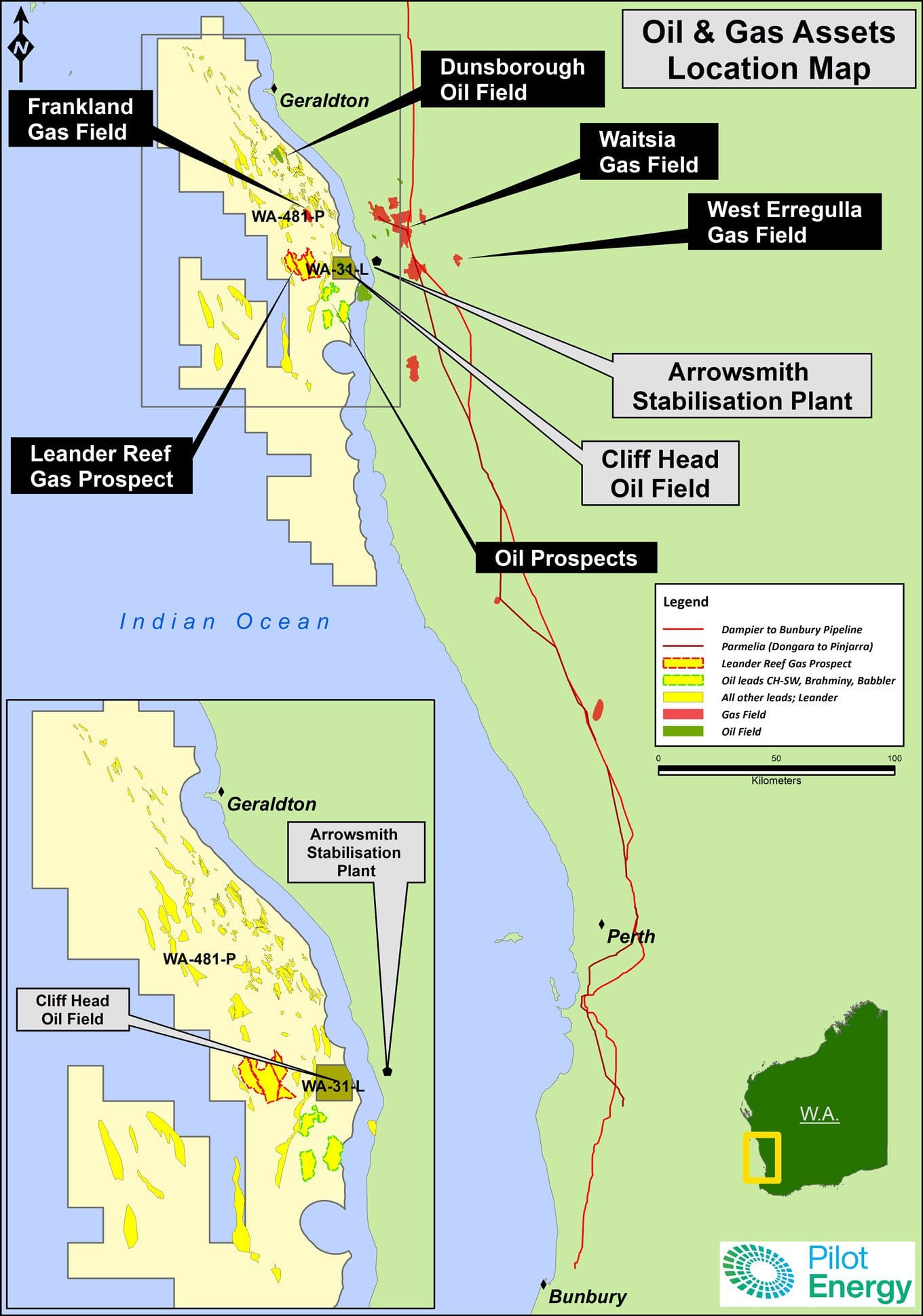

ASX-listed Pilot Energy, which has financial responsibility for the Cliff Head oil platform near Dongara, may need significant injections of capital to survive the year, according to its annual report released in late December.

Pilot is in the process of buying out its Cliff Head joint venture partner, Triangle Energy, to achieve full ownership of the 20-year-old platform, 350km north of Perth, which stopped producing oil in 2024.

The oil and gas junior, which now has just a 21 per cent interest in the facility, has agreed to pay all ongoing costs associated with the wells, platform and pipelines, even though the purchase is not yet completed.

The proposed transaction has been reconfigured many times over the past few years.

The troubled deal hit both companies hard in December 2024 when Pilot missed a $900,000 payment. The open disagreement pushed the Triangle share price down by a third, and Pilot scrip plunged 50 per cent, tanking the value of the two companies to $8.4 million and $8.2 million, respectively.

A year later, the market values Triangle and Pilot at $3.1 million and $5.4 million, respectively.

A burden on Pilot has been complying with a direction from the offshore regulator NOPSEMA to make Cliff Head safe after production stopped, which has cost more than expected.

Since the September 2025 end date for the annual accounts, Pilot has made several moves to shore up its finances.

These include arrangements with financiers to bring forward payments of petroleum resources rent tax (PRRT) refunds and Federal research and development incentives, pushing back the potential payment date for $5.8 million of convertible notes to December 2026, and selling an option to buy land to Strike Energy for $700,000.

Pilot also secured a $500,000 short-term loan from existing shareholders and paid three consultants in shares rather than cash.

In October, Pilot announced plans to develop a data centre powered by unused gas-fired turbines at its wholly owned Arrowsmith plant, built to process oil from Cliff Head, with the first unit to be installed by March 2026.

In January, it struck a deal to develop a solar and battery project and another data centre on land it owns near Three Springs that could see it receive up to $10.75 million in upfront and milestone payments.

It is also seeking partners to fund exploration for gas within an offshore permit surrounding the Cliff Head platform area.

However, the main game for Pilot is to reuse the shuttered Cliff Head production facilities to store carbon dioxide under the seabed for use by paying customers and a future Pilot-led low-carbon ammonia plant.

If that or other reuse plans do not come to fruition, Federal law requires the wells to be made safe and the platform and the portion of the pipeline not in state waters to be removed. Five years ago, Triangle estimated the cost to be $29 million.

Pilot is also developing with Capture6 direct air capture technology to separate carbon dioxide from the atmosphere, backed by a $6.5 million Federal government grant that included a $3 million initial payment.

Pilot reported "a material uncertainty which may cast significant doubt as to whether the group will continue as a going concern," indicating there is a real question about whether it will still be operating in 12 months.

The independent auditors' report by RSM concurred, saying Pilot Energy "incurred a net loss of $7,149,591 during the year ended 30 September 2025 and, as of that date, the Group’s current liabilities exceeded its current assets by $23,776,951."

"These events or conditions, along with other matters as set forth in Note 2, indicate that a material uncertainty exists," RSM wrote.

The matters Pilot noted included a reversal in net annual cash flow from a $2.1 million inflow to an outflow of $2.5 million and an operating cash flow deficit of $5.9 million, following a $5.3 million outflow the year before.

RSM wrote that "Our opinion is not modified in respect of this matter," which, under Auditing Standard ASA 570, indicates that Pilot has made adequate disclosure about the material uncertainty it is facing and that its directors' decision to prepare the books on the basis that it is a going concern was appropriate.

Pilot Energy chief executive Brad Lingo said the material uncertainty disclosure was a standard accounting requirement for companies at Pilot’s stage of development and related primarily to funding timing rather than asset quality or project viability.

Pilot first disclosed the risk of it not continuing as a going concern in its half-year accounts published in June.

Lingo said the $23.8 million working capital deficit "does not directly equate to an immediate cash funding shortfall," as its liabilities due within 12 months were not all cash related.

Pilot's current liabilities at its reporting date of September 2025 included $8.7 million in loans, with the largest from Triangle Energy and Capture6. Another $14.5 million in liabilities is from convertible notes, which can normally be repaid in shares rather than cash, but only if the noteholders agree.

The annual report notes that, for Pilot to remain a going concern and fund its business, it may need to raise additional working capital by issuing shares and taking on more loans.

Lingo, who had led Pilot since 2020, said the material uncertainty about Pilot’s near-term future would not hamper efforts to secure more working capital.

In addition to seeking financing, Pilot plans to continue to bring forward its PRRT refunds, attempt to sell up to 60 per cent of its interest in the carbon storage and ammonia projects, and chase grants from the Federal and WA governments.

Lingo said the uncertainty would also not reduce the chance of it being awarded government grants.

His confidence is supported by the action of the Federal government. It is understood that in December Pilot received an additional $500,000 from the carbon capture grant allocation - six months after the company first disclosed the risk that it may not be able to continue as a going concern.

"Pilot continues to progress discussions across several government funding pathways, particularly in relation to carbon storage and clean energy initiatives," Lingo said.

All the info and a bit of comment on WA energy, industry and climate every Friday