Is Black Mountain's Kimberley dream fracking impossible?

Investors beware: after spending more than $40 million in the Canning Basin, the US-owned company's continued pursuit of remote gas appears to be throwing good money after bad.

Investors beware: after spending more than $40 million in the Canning Basin, the US-owned company's continued pursuit of remote gas appears to be throwing good money after bad.

ANALYSIS

Since Texan oilman Rhett Bennett bought an exploration permit in Western Australia's Kimberley region in 2019, there has been a lot of cash burned and little progress.

In January, Bennett's Black Mountain Energy finally won the backing of Western Australia's Environmental Protection Authority (EPA) to drill up to 20 exploration and appraisal wells using hydraulic fracturing (fracking).

After seven years and a bill of more than $40 million, the EPA's recommendation was a rare step forward for Bennett's Project Valhalla, but there is a long way to go before a well is drilled.

Even if exploration proves the Canning Basin to be as good underground as US basins that have powered a fracking boom, the above-ground risks for investors are enormous compared to Texas.

Black Mountain sought WA environmental approval in 2021 but did not initiate the Federal process until 2024.

It is proving more difficult to satisfy the experts in Canberra.

After reviewing the studies submitted to the WA EPA, the Federal regulator concluded that Black Mountain had not justified its claim that the drilling would not impact local water resources. There was also a real risk that vulnerable species protected under federal law could be affected.

In December, the Independent Expert Scientific Committee advising the Federal Government published its findings, which damned Black Mountain's reassurances as "largely unsupported" by a "limited and disjointed" assessment.

Further analysis of the groundwater risks recommended by the committee will only increase Black Mountain's costs and delay a Federal decision.

Within the state's jurisdiction, the EPA's green light is only a recommendation.

The Appeals Convenor now has to consider an unprecedented 8000 appeals against the EPA's call, and then submit a report to Environment Minister, Matthew Swinbourn, who makes the final decision.

Weighing on Swinbourn's mind will be the Labor Party's November conference, which voted to ban fracking across WA.

The vote is not binding on the Government, which is facing growing disenchantment among Party members over its environmental record.

With two other contentious environmental decisions due this year - Alcoa's mining and Woodside's Browse gas project - taking a stance against powerless Black Mountain would be an easy way to placate the lay party.

Should Swinbourn support Black Mountain's initial 20 wells, the company will have to repeat the lengthy EPA process to drill any further, with no guarantee that future EPA boards and environment ministers would reach the same conclusion.

Even with environmental approval from both levels of Government, there remain two substantial hurdles before a drill rig can be put to use, but how high they are is not yet known.

The WA Government is five years late implementing the safeguards it promised would be in place before it would allow fracking to occur.

Two safeguards are particularly important to the viability of Project Valhalla.

A promised, enforceable Code of Practice defining minimum standards for fracking activities, based on scientific research, has not been published.

Without this information, no company can produce a reasonable estimate of the cost in WA to explore and develop so-called tight gas that requires hydraulic fracturing.

Labor has also promised the Traditional Owners a veto over fracking, but has yet to publish any details on how this would work.

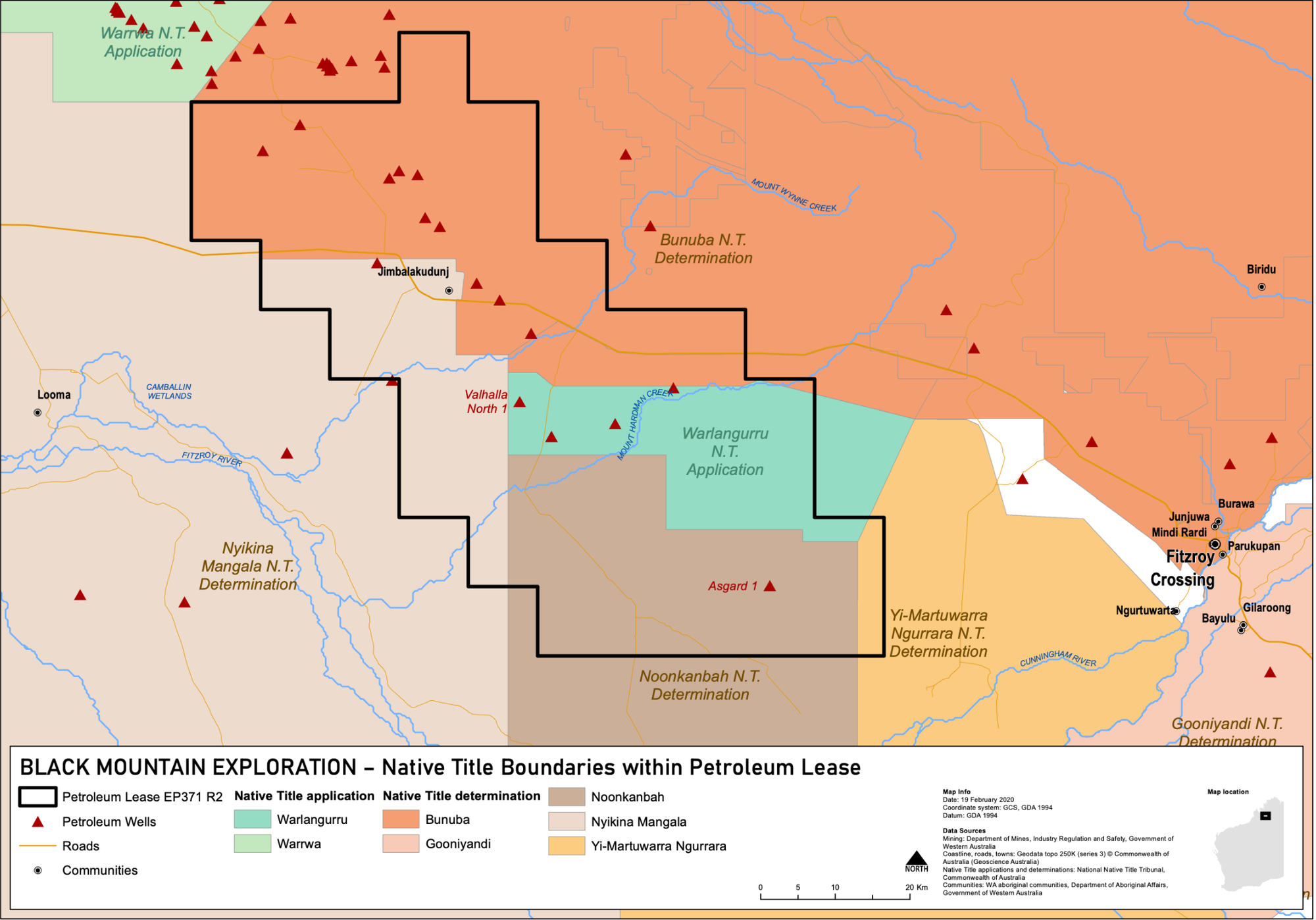

Black Mountain is understood to have the support of the two Traditional Owner groups in the southern part of Exploration Permit 371, where it wants to drill the initial exploration and appraisal wells: the Noonkanbah and Warlangurru people.

However, fracking is not welcome in the northern part of EP 371, raising doubts about whether this area could be developed if initial drilling results are positive.

The Walalakoo Aboriginal Corporation, representing the Nyikina Mangala people who have Native Title over 18 per cent of EP 371, made its opposition clear in a January Facebook post:

"We have always been clear and consistent in opposing fracking and have long held contractual rights of veto over fracking in any agreements made in respect of oil and gas extraction."

The Bunuba people, whose Native Title determination covers the much-drilled northern 40 per cent of EP37,1, have a similar stance.

Traditional Owner Millie Hills, who was a National Party candidate in the last state election, said in November that her people voted not to support a retention lease that Black Mountain sought.

"We dont agree at all to fracking, we think it is going to ruin the countryside," Hills said.

"Water is more precious than gas."

Depending on how the state government structures the Traditional Owner veto, Black Mountain also risks that currently supportive groups may change their minds in the future.

Once it has approvals for the initial drilling, Black Mountain wants to bring new investors into the deal.

Those investors need to know that approvals are only one factor that makes Kimberley fracking a high-risk, low-reward proposition.

Project Valhalla is located in a remote and expensive region, even by the standards of Western Australia's sparsely populated north. That, and flooding in the wet season, will make Project Valhalla expensive to develop and operate.

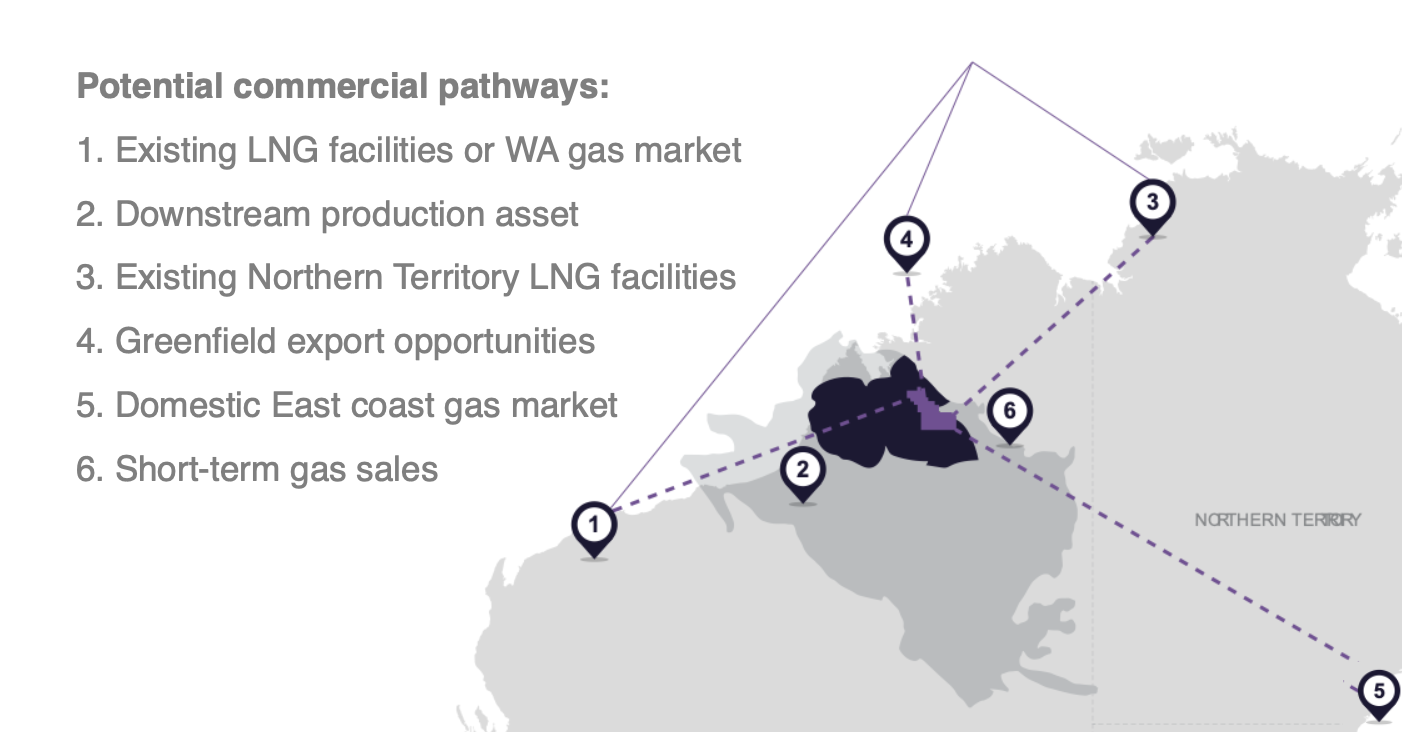

The remoteness also makes gas markets difficult to access.

The most discussed option is a 1000-kilometre pipeline to Woodside's North West Shelf (NWS) gas export plant in Karratha, which will have increasing spare capacity in the coming years.

Woodside has already permanently shuttered one of the five liquefied natural gas (LNG) trains, and restrictions on nitrous oxide emissions imposed by the Federal Government in 2025 may force the closure of the two other older trains.

That leaves the cleaner running Trains 4 and 5, which have a total capacity of about 9 million tonnes per year.

However, Woodside and other companies with a stake in the North West Shelf planned to develop the offshore Browse gas fields and process 11 million tonnes of gas a year at the NWS plant.

They may now need to reduce that output, but there is clearly no room for Project Valhalla gas at the NWS while the Browse project is alive.

ASX-listed Equus Energy is pursuing any future spare capacity at the adjacent Pluto LNG plant.

The option to export the gas through Darwin in the Northern Territory has similar problems of lengthy approvals to build an extraordinarily expensive pipeline to gas export plants with operators - Santos and INPEX - that have their own plans to keep them full.

A new, or greenfield, LNG plant and export facilities would be ruinously expensive. It is a move even major players take with great caution.

A pipeline to the East Coast gas market is also unlikely. It would require credible customers to sign long-term purchase agreements to support financing for the pipeline construction and build-out of Project Vahalla to large-scale production.

But why would these customers commit to a high-cost and unproven gas province?

Project Valhalla is, in industry parlance, stranded gas: not just physically but commercially.

Any option to export the gas requires substantial investment.

That can be justified only if Black Mountain demonstrates beyond doubt that the field can reliably produce large volumes of low-cost gas.

But how can Black Mountain scale up the operation if it cannot get the gas to market?

Interim options such as trucking LNG from a small on-site plant would be prohibitively expensive.

The world is not short of gas, and if, as gas spruikers claim, demand will grow for some time, there is ample untapped supply that is more economically viable than the Kimberley.

If investors who want to back gas think Project Valhalla is the best place to park their cash, they haven't looked very hard.

All the info and a bit of comment on WA energy, industry and climate every Friday