🗡️ Who murdered the Murujuga rock art science?

Special Cluedo™️ edition 🔍 Was it Mr Cook or Prof Smith?

Woodside and BHP have responded to the energy transition by heading in opposite directions. Here are 13 takeaways about Woodside's future. They will need some luck.

ANALYSIS

BHP shifting its oil and gas assets into Woodside Petroleum in exchange for shares for its shareholders shows two companies tackling the energy transition in very different ways.

From what is known so far, here are, coincidentally, 13 key takeaways. The 2020s might be an unlucky decade for Woodside shareholders.

BHP chief executive Mike Henry is focused on what he calls future-facing commodities essential for the energy transition, such as copper and nickel.

Using Henry's logic, Woodside is embracing commodities that may not be of the past but certainly have a limited future.

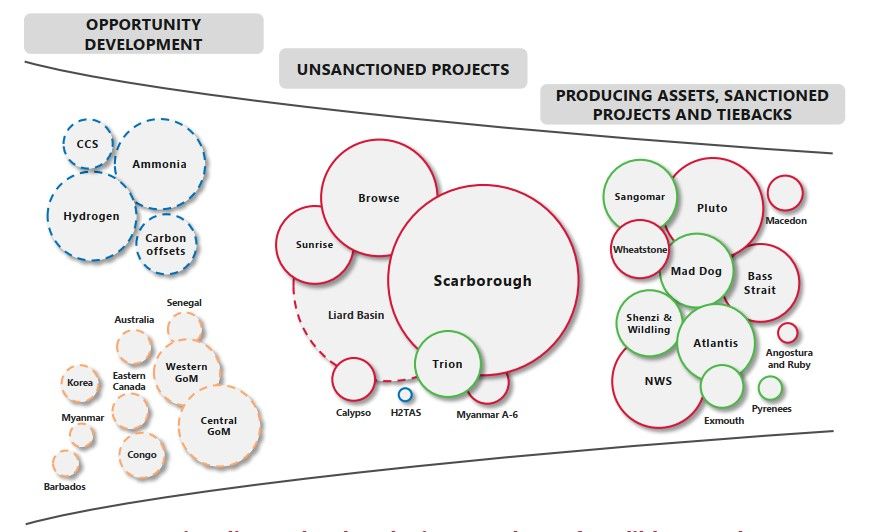

Woodside's view of their opportunity hopper if they swallow BHP's assets supports that view.

All oil production (green circles) in the mix comes from BHP except for Sangomar that Woodside is now developing off the coast of Senegal.

As a result, Woodside can no longer argue it is a greener investment than most hydrocarbon producers because it is gas-focussed, and gas supports the energy transition.

Its queue of potential projects, except for a small hydrogen project in Tasmania, is all hydrocarbons. There is no indication of any move to a different business model any time soon.

Woodside chief executive Meg O'Neill is pushing blue hydrogen made from gas with emissions buried or offset, instead of green hydrogen, claiming it is cheaper.

However, there is growing doubt that blue hydrogen is clean or cheap.

A recent analysis showed blue hydrogen could cause more emissions than burning natural gas for the same amount of heat.

Last week the chief of a UK hydrogen industry association quit because of the "false claims made by oil companies about the cost of blue hydrogen."

Increasingly when blue hydrogen is proposed, customers will ask, are all the emissions captured and stored or offset?

If the answer is no, the hydrogen is not blue, just a lighter shade of grey. If the answer is yes, blue hydrogen's claimed cost advantage might disappear very quickly.

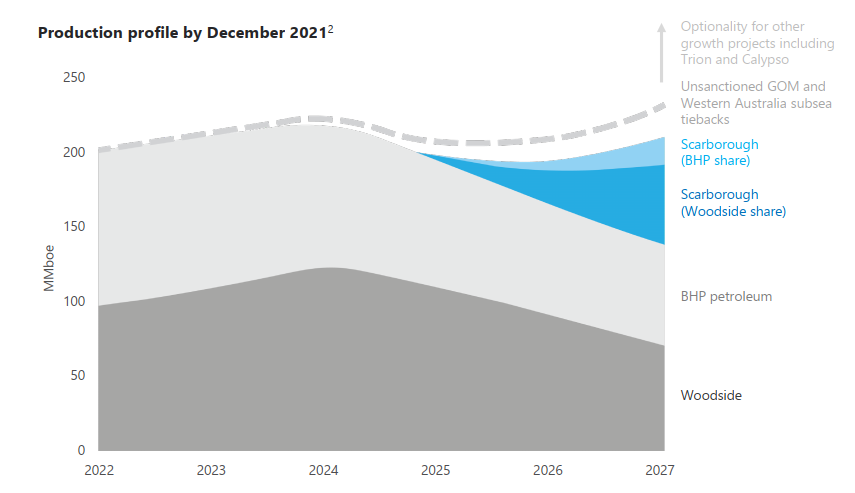

Last week Credit Suisse analyst Saul Kavonic asked O'Neill about a graph showing a steeper decline in Woodside production from 2024 than Woodside had previously communicated.

"I probably wouldn't get my ruler out over that. It's a bit of a stylized cartoon, but it's indicative," O'Neill said.

Really? A major ASX-listed company trying to sell a transformational $20 billion transaction provides cartoons?

Analysts are now likely to ask, is all the information indicative, or just the bits that are later revealed to be unhelpful?

At least the production slide had numbered axes, unlike two other plots in the pack presented to analysts. Graphs without values are typically marked failed from about Year 5 up.

Throughout two teleconferences with investment analysts on Tuesday and Wednesday, O'Neill, again and again, dodged answering sensible questions.

Analysts rightly queried where the claimed annual synergy savings of $US400million would come from and received little clarity.

They should also ask what the transaction will cost and which company is paying those costs. When BHP last spun off assets – into South32 – stamp duty and other transaction costs were close to $1 billion.

Woodside and BHP confirmed a deal was in the offing before the market opened last week. By the time the market closed on Friday, the value of Woodside shares had plunged almost six per cent more than the most similar company, Santos.

This early reaction showed Woodside has a job ahead to convince more than 50 per cent of its shareholders to support the deal ahead of a shareholder vote in Q2 2022.

Already Allan Gray that owns almost five per cent of Woodside is considering voting no.

"It's impossible to tell at this stage, and there's a lot of unknowns and questions that require answering," Allan Gray managing director Simon Mawhinney told The Australian.

Woodside will need to become more forthcoming on detail to earn the trust of its shareholders. Answering questions would be a good start.

However, some detail may not assure investors.

The production slide may not be exact, but O'Neill said it was indicative. And what does it indicate? A greater than 40 per cent drop in production in three years from 2024!

That should scare any investor. It means sharply falling revenue or constant massive expenditure on new projects. And every year, the market, regulatory and financing risks of new hydrocarbon investments will rise.

The production decline points to a queue of assets to be decommissioned. Regulator NOPSEMA will require all wells to be plugged within three years of the end of production and all equipment to be removed two years after that.

Given the production decline, it was no surprise that analysts pushed hard to understand the decommissioning liability last week, especially the 50 per cent equity in the Bass Strait.

When O'Neill was asked what decommissioning liabilities Woodside was taking on, the response was nonsensical.

"I guess you'd need to ask BHP as to how much they plan to adjust their books with this transaction," O'Neill said.

O'Neill's response assumed BHP had a realistic estimate on the books. If that were the case, it would most likely be an industry first.

MST Marquee analyst Mark Samter tried again.

"I'm sorry, Meg but I'm going to push you on the remediation costs…because frankly, I don't see how anyone can remotely profess to make a call on the valuation of this transaction without knowing that remediation number," Samter said.

"It would probably be premature for us to comment as to how much of that will go onto our books, so that'll be work that will progress over the coming months," O'Neill answered.

Woodside is simultaneously claiming the transaction is fully valued, and it has months of work to do on decommissioning costs. Both cannot be true.

While the focus has been on Bass Strait decommissioning, the BHP deal also doubles Woodside's exposure to the costs of cleaning up the North West Shelf.

The Northern Carnarvon Basis, where the North West Shelf Project sits, has a decommissioning liability of $US19.5 billion ($27 billion) between now and 2050, according to a Centre of Decommissioning Australia study released in March.

As the oldest and largest project in the Basin, the North West Shelf will bear a good proportion of that cost.

The eventual decommissioning costs of BHP's assets in the Gulf of Mexico should not be ignored either.

The plunging production shows why Woodside is so desperate for Scarborough to go ahead. Without it, the merged company's main activity would soon become decommissioning.

But just because Scarborough looks good to a company with no other options does not mean it makes sense for investors with unlimited choices to place in their portfolio.

Clearly, BHP was not a fan.

Woodside claims the $12 billion investment will have a 12 per cent rate of return. This published number will undoubtedly be at the most optimistic end of possible outcomes.

Already, Woodside's claim to have put most of the execution risk onto contractors does not hold up.

The demise of long-term LNG contracts will place the project at constant risk of a deteriorating market well before the $12 billion is paid back.

Investors should treat all claims from Woodside about Scarborough with the same scepticism they would apply to the spiel of a car salesman with only one vehicle in the yard.

Just because Scarborough is essential to prevent the decline of Woodside as a company does not mean it is a good investment for shareholders.

That Woodside's fossil fuel business model is doomed is not the judgment of a bunch of greenies but is now part of mainstream business thinking.

As the AFR's Chanticleer column put it:

"The world described last week in the Intergovernmental Panel on Climate Change report on the consequences of global warming will not have room for a company like Woodside, no matter how big it is."

Chanticleer went on to explain why the BHP Woodside deal is structured as it is.

"The deal had to be an equity swap because equity is the only currency that does not require the sign-off by the world's banks and the endorsement of capital markets."

Woodside is a shunned investment, and it will only worsen as climate pressure continually ratchets up over this decade.

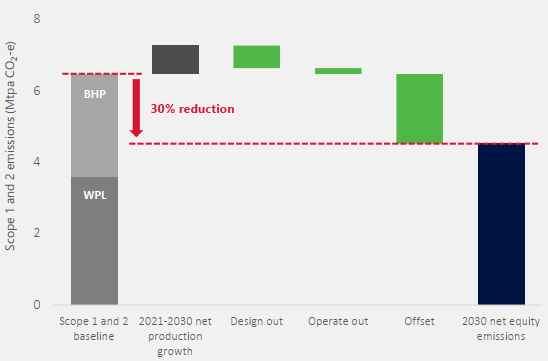

Woodside said its existing plan to cut emissions by 30 per cent by 2030 would apply to the merged entity.

All Woodside claims on emissions should be treated with caution, given the duplicity shown by the differences between its headlined plans for the Pluto LNG plant and the reality.

Woodside's wants to offset about two million tonnes of CO2 a year by 2030.

This will not be easy or cheap. The price of Australian Carbon Credit Units has risen 13 per cent in the past 12 months, and that is likely just the beginning.

In the past, Woodside has said its projects are still economic with a carbon price of $US80 a tonne. By 2030 it will likely need all of that and more.

As climate action picks up, offsets will be in short supply. Many argue offsets are best used to negate emissions that cannot be avoided through technology.

Woodside plans to use offsets to justify continued hydrocarbon production when the world needs production to decline. And of course, the offsets do not over Woodside's Scope 3 emissions when customers burn its product.

Woodside has clearly workshopped its communication strategy and come up with "customer-focused."

Expect to hear it a lot. It lays the groundwork for taking no responsibility for Scope 3 emissions, justifies every expansion in production, and pushes back any work on alternative businesses such as hydrogen.

It has the same level of morality as a slum drug dealer selling to children because they want it. The drivers are the same: only profit matters.

However, Woodside cannot sustain the drug dealing business model because, unlike drugs, hydrocarbon demand will decline.

Unfortunately for Woodside shareholders, moving to greener products only when the market matures means that the companies that matured that market will already be there.

Woodside will be trapped in hydrocarbons or forced to pay exorbitant amounts to buy into established players in the new energy world.

A good number of Woodside shareholders are already unhappy with the deal and their exit last week pushed down the share price.

That is a minor movement compared to what will happen when BHP shareholders find themselves owning an unplanned 48 per cent of the merged entity.

Concern that Woodside is a lousy investment, moral qualms about the climate and funds mandated to avoid fossil fuel stocks will all drive the sale of Woodside shares.

The exit will not be immediate as shareholders try to sell at a good price, but it will put a ceiling on Woodside's share price for some time.

Woodside has consistently failed to find reserves, generally regarded as the core competency of an oil and gas company.

However, over the decades, it has consistently managed to persuade governments to do its bidding.

The list is long, including the Federal Government bugging the East Timorese during negotiations for over the Sunrise gas field and Labor State Governments approving the Pluto project with a near unenforceable domestic gas obligation agreement and bashing the Environmental Protection Authority to withdraw its emission policy in 2019.

A bigger Woodside focused on long-term hydrocarbon production will ramp up its efforts with all governments, especially on climate policy.

But why is this piece titled "doubling down for a dirty decade"?

Woodside does not influence markets, the IPCC, the IEA, or Australia's trading partners.

Given the change in government and investor sentiment in the past two years, by 2031, the world will be a very uncomfortable place for the Woodside its board is now planning.

All the info and a bit of comment on WA energy and climate every Friday