Woodside posts record production but profit down to $3.8b

Australia's biggest oil and gas producer has posted record production and cut costs, but weak fossil fuel prices have weighed on profits

A company with less than $5 million in the bank and a boss who lives in the US will soon get a red or green light from WA's environment watchdog.

A company with less than $5 million in the bank will soon hear the verdict from WA’s environment watchdog on its plans to drill for gas in the remote Kimberley.

It will be a pivotal moment for Black Mountain Energy (BME), which suffered the ignominy of delisting from the Australian Stock Exchange due to investor indifference.

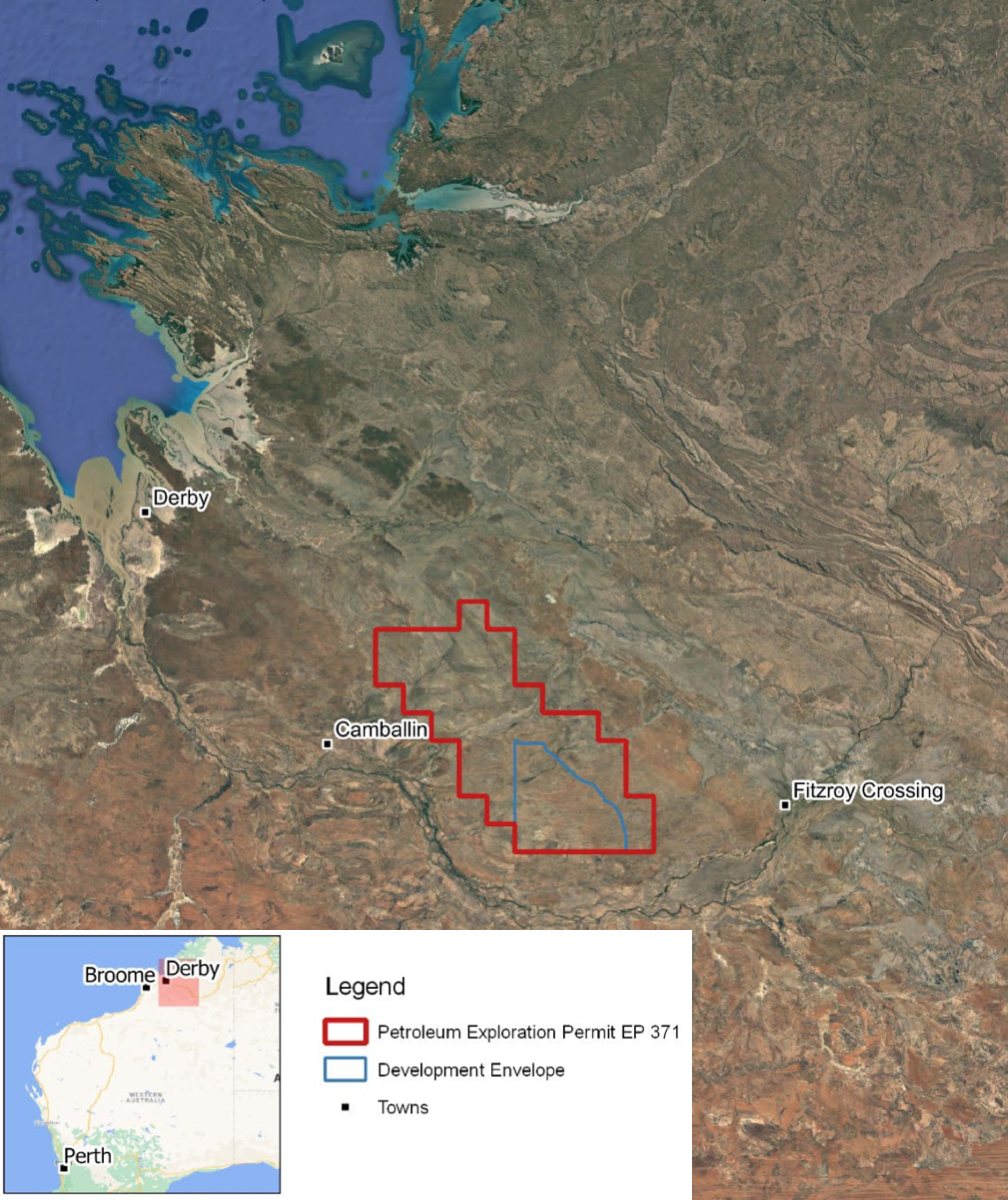

For six years, US-based Rhett Bennett has pushed to produce gas from the remote Canning Basin that requires controversial hydraulic fracturing, or fracking.

Bennett’s firm, Bennett Resources, entered the Kimberley by buying petroleum titles from the Japanese giant Mitsubishi.

The oil and gas potential of the Canning Basin attracted major international companies, but they all left disappointed, selling out to smaller companies.

Hess departed in 2012, followed by ConocoPhillips two years later. Mitsubishi sold out in 2019, and Andrew Forrest’s Squadron Energy departed in 2021, then Origin left in 2022.

The majors had been put off by the high costs of operating in an area remote even by the standards of WA’s resources sector. The distance to any sizable gas market was another major impediment.

In late 2021, Bennett’s company gained an exemption for the WA Government’s ban on exporting onshore gas.

This opened up the possibility of exporting gas through Woodside’s underutilised North West Shelf gas export plant, but only if a pipeline to Karratha, almost 1000km long, was built.

Soon afterwards, the company was listed on the Australian Stock Exchange as Black Mountain Energy, raising $11 million at 20 cents a share, leaving Rhett Bennett with a 78 per cent stake.

Investors lost from day one, with shares trading between 12 and 15 cents for a few months before sitting at about two cents for most of 2023.

In 2022, BME increased its estimate of groundwater used for each well by a factor of 2.5 to 100 million litres.

The standing of the new company was not helped by the corporate regulator, ASIC, issuing it three infringement notices in 2022 for greenwashing.

“BME had no credible basis for asserting that the natural gas it produced would be carbon neutral,” was one of ASIC’s concerns.

BME paid almost $40,000 for the infringements, an action that is not an admission of guilt.

The company briefly considered running computer servers in the remote outback to mine cryptocurrencies using power generated by its gas.

In September 2022, it told investors environmental permitting was two-thirds complete, and it expected formal approval by mid-2023.

In late 2023, the board called it quits, recommending the company withdraw from the stock exchange.

The board argued that after spending more than $40 million on what it dubbed Project Valhalla and having $7.5 million of cash, a market capitalisation of $8.8 million “places no value on the Company’s assets.”

The company needed more money for day-to-day expenses, but the market that wouldn’t buy the existing shares had no appetite for new ones.

“Recent capital raising initiatives have not received significant support from shareholders outside of entities associated with executive chairman Rhett Bennett,” according to the company statement.

Today, BME is an unlisted public company with $4.8 million in cash as of June 30 2025, according to its half-yearly report lodged with ASIC, which revealed a $809,000 cash burn over six months.

To keep its exploration permit EP 371, it was required to spend about $1 million on a seismic survey by January 2025 and about $8 million on an exploration well a year later, according to the WA petroleum title register.

However, in 2024, BME successfully applied to delay these commitments by two years, and in November, it applied for another deferral.

Apart from cash, the major components of BME’s balance sheet are a $3 million provision for rehabilitation and a $43 million valuation of its “exploration assets.”

The exploration asset value is the amount “expected to be recouped through sale or successful development” of Project Valhalla.

If the project does not receive environmental approval, the asset is effectively worthless, and the rehabilitation bill becomes imminent.

That would leave little leeway between available cash and operating and cleanup costs.

The EPA published BME’s response to submissions about its proposal in November and is expected to publish its recommendation shortly.

If the EPA greenlights Project Valhalla, BME still needs approval from WA environment minister Matthew Swinbourn, who will first consider any appeals against the EPA's decision.

Objections would likely flood the Appeals Coordinator.

Swinbourn is also aware that just weeks ago, the WA Labor Conference voted in favour of banning fracking throughout the state.

In addition, the Federal Department of Climate Change, Energy, the Environment and Water decided in February that the project must be assessed under the EPBC Act.

If both WA and Federal environment ministers sign off on the project, BME does not have the resources to do it.

In March, George Witman, president of Bennett's US company Black Mountain Oil and Gas, said the project was for sale.

“We’ve got all the lease rights, we’ve got an export exemption, we’ve got some of the EPA permitting and seismic permitting done,” Witman said.

“But it’s probably something that needs to be a major operator … it’s not really something we can do with the resources and the team that we have.”

Rhett Bennett, who is chief executive of Black Mountain Oil and Gas, later tried to walk the statement back, telling Energy News Bulletin the company was not actively seeking joint venture partners.

"We are most certainly not abandoning the project. Far from it, we continue to invest capital into it every month as we work with regulators," he said.

"But do assume at some point in one to two years, when permitted, we will bring in partners on the project, as is common risk mitigation practice in the oil and gas industry," he said.

BME did not respond to Boiling Cold's questions.

All the info and a bit of comment on WA energy, industry and climate every Friday