Gas seeping to surface from Chevron's Barrow Island oil operation

The WA environment regulator is investigating unknown amounts of hydrocarbons rising to the surface on the Class A nature reserve.

Andrew Forrest's Squadron Energy is pulling out of plans to frack the Kimberley for gas citing climate concerns, but the minor partner may continue the work.

EXCLUSIVE

Andrew Forrest's Squadron Energy is abandoning plans to frack the Kimberley for gas a year after acquiring new exploration acreage, but Squadron's partner may continue the work.

Squadron and its 20 per cent equity partner Goshawk acquired the 5300 km2 EP 499 exploration permit in August 2020. The partners planned a six-year $3.75 million work programme of seismic surveys and two exploration wells.

The effort appeared in conflict with Forrest's concerns about climate change and the commitment of iron ore miner Fortescue that he chairs to net-zero emissions by 2030.

In June, Forrest criticised Australia's two largest gas companies – Santos and Woodside – for their contribution to greenhouse gas emissions.

"Only a fossil would back long-term fossil fuel in today's world," Forrest said.

A spokesperson for Squadron Energy said the company continuously reviewed its investments to ensure they were aligned with its climate policy and actively supported the transition to a low carbon economy.

"As part of this ongoing review, Squadron Energy has made the strategic decision to exit from our limited Canning Basin permits," the spokesperson said.

"This process is in advanced stages."

However, Squadron's exit does not necessarily mean the exploration will stop.

Boiling Cold understands Goshawk, which operates EP 499, continues to progress the work program independent of Squadron's exit.

Reprocessing of seismic results costing about $1 million is planned for the next 12 months, followed by a $3.5 million seismic survey.

Squadron first partnered with Goshawk in 2016 to apply for 220,000km2 of permits.

"We believe that developing WA's onshore petroleum resources responsibly is a key part of delivering value for WA, such as employment opportunities and energy security," a Squadron spokesperson said in 2015.

Squadron and Goshawk had extensive permits in the Kimberley that were affected by fracking restrictions announced by the McGowan Government in late 2018.

The two companies held numerous special prospecting authorities, an early-stage permit, that were excluded from permission to perform hydraulic fracturing, or fracking. These SPAs are now listed as expired on the WA Government's Petroleum and Geothermal Register.

Some exploration permits held by the companies were affected by a ban on fracking on the Dampier Peninsula.

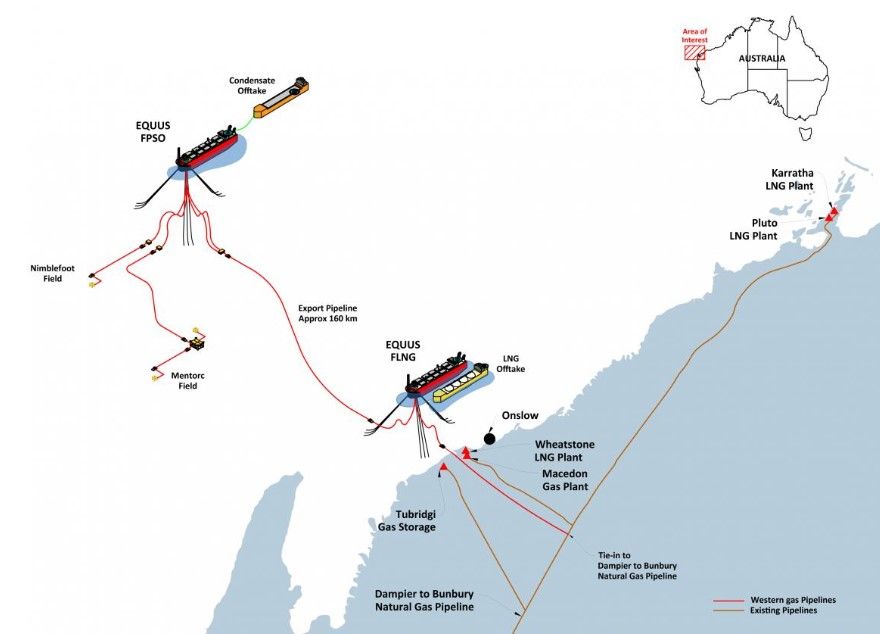

Privately-owned Goshawk is run by Andrew Leibovitch and Will Barker, who also control Western Gas that is trying to monetise Carnarvon Basin offshore acreage bought from US-major Hess for a nominal amount.

Environs Kimberley executive director Martin Pritchard congratulated Forrest on the decision.

"He's recognised that the Kimberley is one of those special places in the world that has to be protected from industrialisation," Pritchard said.

"Other companies would be wise to follow suit,

"There is no doubt that the shale oil and gas in the Canning Basin is going to be a stranded asset as opposition to fracking continues to mount, and the world becomes increasingly constrained in terms of carbon and methane emissions."

Forrest's Squadron Energy has joined a long list of companies that have invested time and money trying to develop oil and gas in the Kimberley and then left the region.

ConocoPhillips and PetroChina withdrew in 2014, leaving the acreage to junior New Standard Energy that was suspended from the ASX five years later for not including rehabilitation liabilities in its financial reports. In 2020 New Standard Energy said it did not have the money to plug and abandon four exploration wells.

In 2015 South West alumina producer Alcoa, one of the State's largest gas consumers, killed a $40 million deal with Buru Energy to fund gas exploration and production.

Apache Energy farmed into permits held by Buru Energy and Mitsubishi in 2013, funding two exploration wells. Quadrant Energy bought Apache's Australian interests in 2015 and pulled out of further involvement in the Kimberley.

In 2017 Buru and Mitsubishi dissolved their joint venture, with Buru taking control of the oil-focussed permits and Mitsubishi retaining gas acreage.

Mitsubishi sold exploration permit EP 371 to a subsidiary of Houston-based Black Mountain Oil and Gas in 2018, ending seven years of activity in the Kimberley.

In a move counter to the last decade's trend in late 2020, Origin Energy farmed into two permits held by Buru Energy and Rey Resources with a $35 million commitment to fund seismic work and two exploration wells over two years.

In August, Black Mountain subsidiary Bennett Resources submitted initial environmental approval documents for exploration wells that use fracking to the Environmental Protection Authority. The EPA's assessment will be its first since the State Labour Government lifted a complete moratorium of fracking in 2018 and added a requirement for EPA approval.

Main image: Andrew Forrest at an FMG iron ore mine in the Pilbara. Source: Fortescue Metals Group.

All the info and a bit of comment on WA energy and climate every Friday