🗡️ Who murdered the Murujuga rock art science?

Special Cluedo™️ edition 🔍 Was it Mr Cook or Prof Smith?

South Korea, Japan and China's tightened climate goals will crunch Australian thermal coal, make LNG investments harder and possibly kill Santos' Barossa LNG project.

South Korean President Moon Jae-in today committed the country to achieve net-zero greenhouse gas emissions by 2050, joining fellow East Asian economic giants China and Japan.

Moon's declaration to Parliament followed Japan's embrace of net-zero emissions by 2050 two days ago and China's commitment to a 2060 target last month.

"Together with the international community, we will actively respond to climate change and aim for carbon neutrality by 2050," Moon said, according to Carbon Pulse.

"By replacing coal power generation with renewable energy, we will create new markets and industries and create jobs."

Reports of Moon's speech have not mentioned gas serving as a transition fuel between the retirement of coal-fired power stations and an increase in renewable energy production.

"We will make smart industrial complexes — i.e. making them into low-carbon and green industrial complexes — and expand financial support to local renewable energy businesses," Moon said.

"The Korean New Deal is a people-centred development strategy."

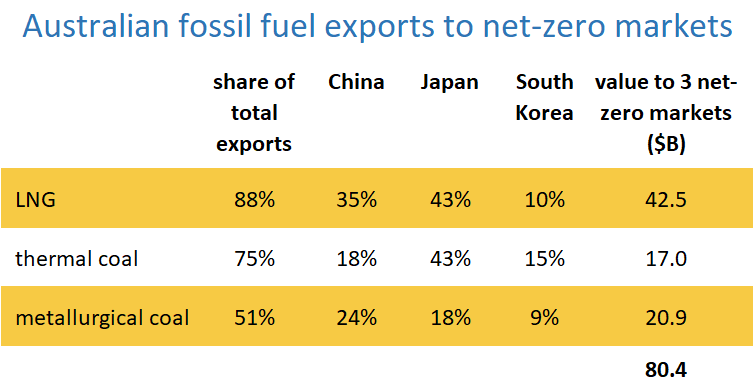

China, Japan and South Korea together imported $80 billion of coal and gas from Australia in 2019.

The value and volume of thermal coal exports are likely to be hit first, with early details of how the three countries will implement their climate pledges expected over coming months.

Demand for metallurgical coal may be untouched for some time until low carbon steel-making technologies are commercialised.

The three countries take 88% of Australia's LNG exports.

Sanctioning of major projects to supply gas to LNG plants, such as Woodside's Scarborough field and the Santos-led Barossa development, will be difficult before the final policy settings in these three major markets are understood.

Barossa gas may remain stranded due to its carbon intensity of 1.36 tonnes of carbon dioxide for each tonne of LNG produced. This is about 60 per cent higher than Ichthys, the current dirtiest offshore LNG project in Australia.

Santos chief executive Kevin Gallagher today did his best to spin the dire prospects for Barossa in the face of increased climate ambitions among the dominant LNG buyers as "incredibly exciting."

Speaking before the Korean announcement, Gallagher told the AFR that Japan's pledge would "drive innovation to accelerate zero-emissions LNG and also zero-emissions hydrogen products in the market."

Gallagher said Santos' plan to inject 1.7 million tonnes of CO2 a year at Moomba "could be a real game-changer for our industry."

The Moomba project would offset about a third of the 5.04 million tonnes of greenhouse gases a year from the production and liquefaction of Barossa gas, leaving the product as still the most climate-damaging LNG to depart Australian shores.

A constrained LNG market increasingly interested in carbon-neutral cargoes will favour the cheapest gas to produce with the lowest carbon intensity to offset.

Last week Santos told the market that Barossa was progressing to be ready for a final investment decision by the end of the year "subject to business conditions, joint venture agreements and relevant approvals."

Santos is looking to South Korea's SK E&S and Japan's JERA to invest in the Barossa. Both companies will want to understand their home countries' appetite for emissions-intensive gas before making an investment decision.

If Barossa does not go ahead and other gas cannot fill the Darwin LNG plant Santos' buy out of ConocoPhillips' northern Australian assets to clear the way for the project will prove to be an expensive mistake.

Main image: South Korean flag. Source: Sergei Mazhuga on Unsplash

All the info and a bit of comment on WA energy and climate every Friday