This week in WA energy and climate

• LNG costs blame • WA fumbles care of ancient rock art •

Is Woodside a net-zero hero?

Woodside announced this week that its Pluto LNG plant, due for a doubling in capacity it develops Scarborough, will abate 30 per cent of its emissions by 2030 and be net-zero by 2050.

So how good is this? Well, the devil is in the detail, and there are some interesting comparisons with other projects going ahead in WA.

I hope to get an analysis to you early next week. Unfortunately, there were no new Boiling Cold stories as I had push out some freelance work.

The top end of town

Crikey asked the question: Is it ethical for the former WA treasurer to join the Rio Tinto and Woodside boards? The story points out that the Forrest and Rinehart/Hancock families have amassed a combined wealth of $68 billion from WA's iron ore. BHP and Rio Tinto have also done well, of course.

"When it costs Rio less than $25 a tonne to dig the stuff up and ship it out, a price north of US$200 a tonne is clearly a bonanza," Stephen Mayne wrote.

"Does Wyatt really think that WA taxpayers should only pocket about 5% of current sales?"

Now that Ben Wyatt is on the Rio payroll, I guess we will never know.

Misplaced blame for project blowouts

The Australian Resources and Energy Group, the resources sector's industrial relations arm, is campaigning for so-called greenfield workplace agreements that would stop any industrial action on a project for up to six years.

The story said resources companies "contend protected and unprotected industrial action was 'a key contributor' to Chevron's Gorgon LNG project, Woodside's Pluto LNG project, the Curtis Island gas field and Inpex's Ichthys projects running over time and budget."

Let's be blunt, at least for Gorgon and Ichthys, this nonsense.

I don't know enough to comment on Pluto and the three Curtin Island projects.

Gorgon started construction with a shockingly underdone design by KBR and continued with inept project management by Chevron. Any contribution industrial action made to the Barrow Island debacle was minute in comparison.

Ichthys was blighted by rework and constant battles between contractors and Inpex that continue 2½ years after the first LNG.

This week Inpex counter-sued Samsung Heavy Industries over a final payment of $US116 million the Korean shipbuilder wants for the central processing platform.

The latest dispute is a tiddler compared to the multi-billion-dollar legal mayhem that continues over the onshore construction.

Random happenings

OpenNEM, a dashboard of Australia's electricity market, has been upgraded, including data on each facility. Unusually, WA was not ignored. Well worth a look.

A new CSIRO study confirms that wind and solar are the cheapest sources of new electricity generation in Australia. Notably the assessment included the cost for any additional storage and transmission required to support renewables. Unfortunately, the report concentrates on the misnamed National Electricity Market of the five lesser states, so there is no WA-specific information.

Western Power has an interesting read about its Grid Transformation Engine, the tool it uses to plan its long-term network needs, as well as where to put the next community batteries and standalone power systems.

Chevron and AGL have participated in $27 million of funding to Raygen Resources, an Australian company with a unique approach to long term energy storage that combines solar PV, solar thermal and the Rankine cycle (that I very dimly remember from second-year thermodynamics).

NERA has launched a technical challenge program for small businesses. In the first round, Chevron is looking for solutions to three problems, including inspecting hazardous areas with drones.

Buru Energy has completed a $1 million capital raise and is now fully funded for this years Canning Basin exploration program.

Environs Kimberley director Martin Pritchard said the Environmental Protection Authority should first approve all clearing for seismic testing in the Kimberley by Buru or New Energy.

The call came after last month's revelation that Buru has cleared 14,000km of tracks since 2009, with only approval from the Department of Mines, Industry Regulation and Safety required.

DMIRS is charged with promoting industry growth and works under the direction of its Minister. The EPA is independent, and its sole role is to protect the environment. It is not hard to see why industry and environmentalists would want different regulators involved.

State Government drops the ball on rock art

If you think something should be on the World Heritage List, it would also be logical to think it is worth looking after. When it comes to the Murujuga rock and the WA Government, this is not the case.

There has been no government monitoring of the condition of the rock art since 2016. The State Government has now cancelled a monitoring contract and did not tell the companies supplying the vast bulk of the $7 million cost: Woodside, Yara and Rio Tinto.

There are now questions over the progress towards World Heritage listing

Conservation Council director Piers Verstegen said the impact of industry on the rock art was like "Juukan Gorge in slow motion."

Sadly, without proper monitoring, no one can be sure that is not the case.

What to do about CO2?

The Federal Government has dished out $50 million to six carbon capture and storage projects. No money went to WA. Perhaps Canberra is still waiting to see how its $60 million investment at Gorgon is going.

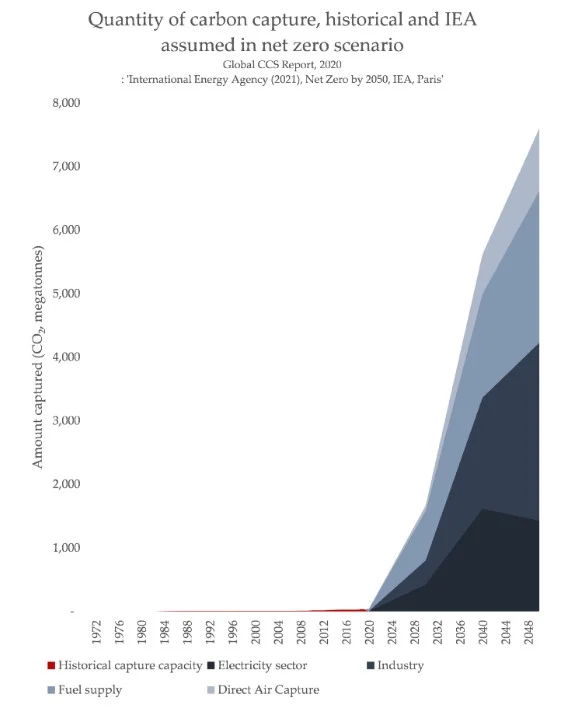

Carbon capture and storage to date has consistently underperformed. Despite this, the recent IEA net-zero scenario that called for no new fossil fuel projects included an extraordinary ramp-up of the technology over the next 30 years. It looks a bit difficult to me. It is a really interesting analysis by Ketan Joshi.

If you can't store it, offset it. The price of Australian Carbon Credit Units hit a record high of $19 a tonne this week as large companies seek offsets to meet their voluntary targets.

Power generation gets all the attention when reducing carbons emission is discussed, but it essentially is the low-hanging fruit. Australia has a lot to do in the forgotten emissions of transport, buildings and industry.

CO2 stays in the atmosphere for centuries, so a company cannot claim to have net-zero emission unless its offsets last as long as its carbon pollution, according to The Conversation. Possible solutions are emitters buying a bond to cover new offsets if the initial offset fails (e.g. a bushfire).

Meanwhile, CO2 levels in the atmosphere are the highest for more than four million years.

Oil and gas issues for APPEA in Perth next week

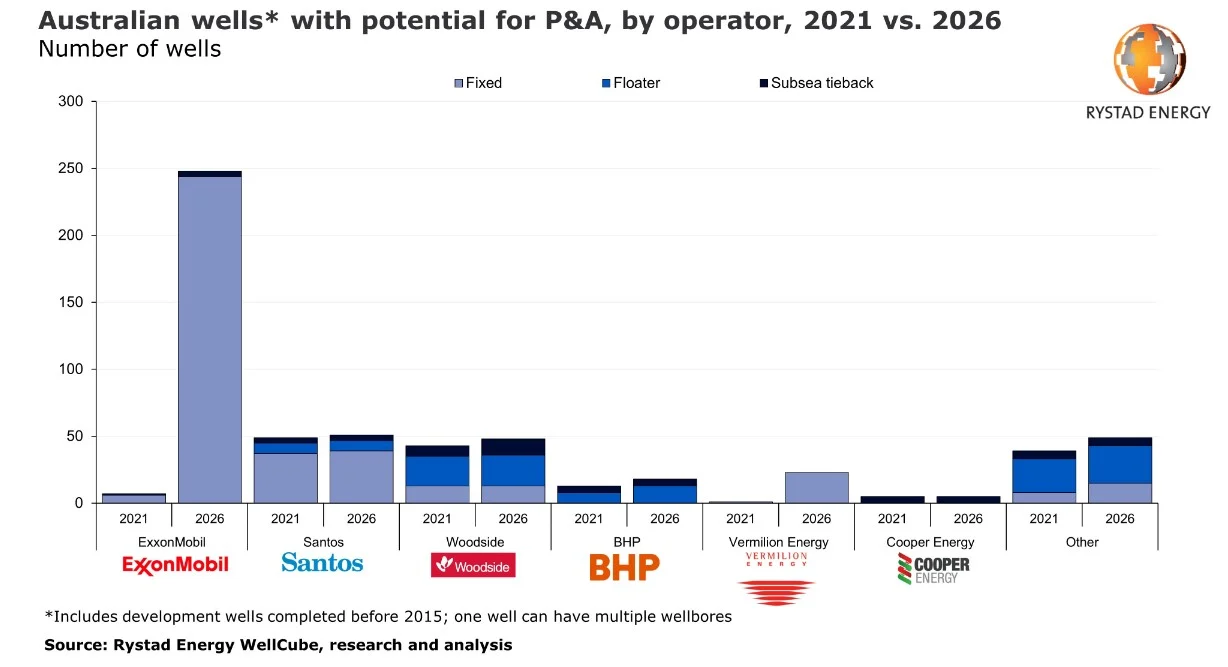

In the next five years number of wells offshore Australia that have ceased production and need to be decommissioned will jump from 160 to 440, according to Rystad Energy.

"Recent developments have made it more difficult for operators to sidestep decommissioning obligations by selling ageing assets," said Rystad Energy senior upstream analyst Jimmy Zeng.

Here is a good graphic on where to look for decommissioning work.

A Senate inquiry has recommended stricter restrictions on the use of seismic testing and more research into the cumulative effect on wildlife. The Wilderness Society said the industry used outdated science and APPEA said the Senators "ignored good science."

"Australian politicians need to use science, data and evidence to drive policymaking, not ideology," APPEA Chief Executive Andrew McConville said. Presumably, this need also applies to climate and the viability of a massive deployment of carbon capture and storage.

NOPSEMA wants offshore workers to answer a mental health survey run by Curtin and UWA to help better understand their concerns. APPEA and the unions back the research.

The oil and gas industry meets in Perth next week at the APPEA conference. Boiling Cold will be there for the three days starting Tuesday.

The G7 is meeting this weekend, and carbon border adjustments are on the agenda. What are they? Essentially tariffs imposed by countries serious about emission reductions (think the EU and the US) on carbon-intensive imports from countries that are laggards (ashamedly Australia).

The Australia Institute thinks this will hurt Australia's $12.6 billion annual exports of alumina and aluminium. If that is the case, Alcoa looks a better bet than South32 that Boiling Cold analysis revealed has two-thirds more emissions to make a tonne of alumina.

Prime Minister Morrison will be in the UK to tell the G7 to chill on all this climate action talk.

Have a better weekend than climate slow-mo Scomo.

Cheers

Pete