BHP's good reason to not back Scarborough

• & green hydrogen and urea from gas get a boost in WA •

Good morning,

A busy week from Boiling Cold with four stories and a tonne of other happenings. Enjoy the read:

Rio Tinto is displaying caution chasing 30% emissions cuts with LNG iron ore carriers while Twiggy pauses before a jump to green ammonia. Both options have their issues.

READ the full story: Rio orders LNG ore carriers after Fortescue dumps gas for green ammonia

The much-doubted Perdaman urea plant on the Burrup Peninsula is now looking real with all of its production pre-sold.

READ the full story: Incitec Pivot backs Perdaman’s $4.6B urea plant with 20-year offtake deal

WA gets the lion share of Federal funding for green hydrogen for two very different projects.

READ the full story: ARENA backs ATCO and Engie with $71M for WA green hydrogen

Same dirt, same location, but South32 emits two-thirds more emissions to make a tonne of alumina than its South West competitor Alcoa. Is it all about fuel choice.

READ the full story: South32's coal-fired Worsley Alumina two-thirds dirtier than Alcoa

And yes we can avoid the worst climate change scenarios, but the time for delay and BS is over. Optimism and urgency is needed now.

READ the full story: The 1.5℃ global warming limit is not impossible – but needs political action now

Boom time again

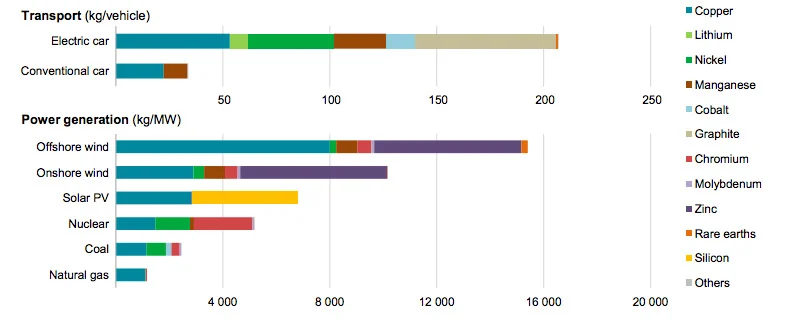

The International Energy Agency predicts that the supply of metals critical for electric vehicles and renewable energy, including copper, nickel and lithium, may need to increase 30-fold by 2040 for global climate targets to be met.

An offshore wind farm needs 12 times the mineral resources of an equivalent gas plant.

At the same time, the iron ore spot price passed $US200 a tonne.

Not surprisingly, the WA resources sector is struggling to get the workers it needs.

Strandline Resources managing director Luke Graham who needs about 300 workers to build a minerals sand mine, said a capital expenditure boom across multiple commodities made WA "a hot market" for labour.

"That is creating a bit of bubble at the moment and lay COVID restrictions on interstate travel and travel from overseas on top, and it creates a bit of a challenge," Graham said.

Lithium player Albemarle wants to restart its Wodgina mine, but the "labour crisis" is slowing down the mobilisation of equipment and people.

Chamber of Minerals and Energy WA chief executive Paul Everingham said the bigger miners are already paying a premium to ensure they have the labour they need.

Is Scarborough an own goal for BHP?

Woodside ex-boss Peter Coleman has said for some time that Scarborough would get the perfect combination of being built when construction costs are low and come online when the LNG market was tight.

Clearly, Scarborough has now missed the low costs window for its main domestic scope of assembling the modules floated in for Pluto Train 2.

The tight labour market may give Scarborough partner BHP second thoughts about backing the project.

Getting partners to agree to sanction a large project is always tricky as they all have different alternatives to place their money and their own perspectives on price and likely final cost.

When Woodside and BHP consider Scarborough LNG, they have more differences than most.

Woodside's portfolio of possible growth projects in singular, while BHP could place its cash in a multiple of booming metals.

More importantly, iron ore is king for BHP and protecting the cash cow would be a top priority for BHP chief executive Mike Henry.

ACIL Allen predicts the construction of Scarborough and Pluto Train 2 will require 3200 workers at its peak. Perdaman's urea plant fed by Scarborough gas needs another 1500 to 2000 workers.

So, if BHP approves Scarborough, the Pilbara could require another 5000 workers.

Does BHP really want the Pilbara labour market to go totally ballistic?

That is a massive risk for its WA operations in exchange for a 26 per cent stake in an LNG project likely to have a lower return than many of its mining options.

Scarborough also comes with a big carbon emissions bump, just as the miner wants to reduce its climate impact.

It will be a question BHP Petroleum boss Geraldine Slattery will wrestle with for the rest of 2021. However, we will have to wait for Woodside chair Richard Goyder to make up his mind to know what side of the negotiation table Slattery ends up on.

Random happenings

Speaking of potential Woodside chief executives, one-time contender Santos boss Kevin Gallagher received some unwanted media attention this week.

In between Woodside and Santos, Gallagher headed up Clough and sat on the board of Forge Group that Clough had a 36 per cent stake in. Clough exited Forge a year before it collapsed, owing $800 million.

The liquidators are taking action against Gallagher and others alleging insider trading, and this week had a win when the court rejected an attempt to strike out part of their claim.

Hopefully, not too much of Gallagher's possible $6 million bonus for staying at Santos is chewed up in legal fees.

You may have noticed I have no problem with big companies getting bagged if the facts support it. "If the facts support it" is an important caveat that a group campaigning against Scarborough has ignored.

Rhyse Maughan, an energy specialist with Rio Tinto, took apart noneedforscarborough on LinkedIn this week. Maughan pointed out that the turtles on the Dampier Peninsular the campaign worried about are 800km from the town of Dampier near the Pluto LNG plant that would process gas from Scarborough. The campaign also compared Scope 3 emissions from Scarborough's gas to the Scope 1 emissions of the Muja power station.

According to the miner's latest annual report lodged with corporate regulator ASIC, Collie's Premier Coal has extracted a better price from Synergy for its coal. The Chinese-owned company made a profit of $6 million, the first for five years. What was not revealed but would be interesting was how long the contract is for.

Shell is preparing to get subsea contractors to bid for supply to the Crux project to feed gas to Prelude. Perhaps the Dutch major is getting more confident it will need the gas after the troubled floating LNG plant shipped three loads of LNG and one of condensate in the past four weeks.

WorkSafe is investigating Electrical Trades Union claims of workers on Barrow Island were poisoned with mercury. That the lengthy Chevron response failed to say the exposure did not happen is telling.

To add to Gorgon's woes, the ETU is taking protected action (aka a lawful strike) on Saturday to protest UGL's rates on the current LNG Train 3 shutdown.

A week ago, Chevron chief financial Pierre Breber told Wall Street that Train 3 would be back up by the end of June. Strikes will not help that schedule.

The Department of Industry, Science, Energy and Resources has pushed back three months its approach to the market to decommission the Northern Endeavor. With contractor engagement only starting by June, the vessel is likely to be staying put well into 2022.

To reduce emissions, the focus is always on cleaner electricity, rather than using it more efficiently.

Richard Branson tackled that with a $US1 million Global Cooling Prize that has been split between two companies that used novel approaches to achieve a five-fold reduction in the climate impact of split cycles air conditioners.

It shows what can be done when urgency is combined with a financial incentive. A bit like a carbon price really.

BP Australia has recorded an impairment of more than $600 million to cover the closure of its Kwinana oil refinery. The UK company will continue to use the site for fuel imports, so this is not the full rehabilitation cost.

Melbourne offshore wind company Oceanex Energy is scouting for sites off WA in Commonwealth waters. This is in addition to the proposal for an offshore wind farm near Myalup in State waters closer to the cost reported by Boiling Cold a month ago.

Gas wars

APPEA chief executive Andrew McConville said it was "time to call out the extreme environmental movement's dodgy shareholder tactics" targeting the oil and gas sector.

"It is time to name and shame these groups."

Um, Andrew, the groups are not secret, and I think they are rather proud of their efforts.

Big gas has no lack of support from the Federal Government with Minister for Energy and Emissions Reduction Angus Taylor "Advancing Australia's gas-fired recovery" on the east coast with $59 million of cash.

If we are having a gas-fired recovery, shouldn't the industry be pulling the rest of the economy forward instead of relying on handouts?

Taylor's cabinet colleague Resources Minister Keith Pitt has vetoed a funding recommendation from the Northern Australian Infrastructure Facility for the first time. The Kaban wind and battery project near Cairns was to have received loans of $280 million.

Pitt wrote that the clean energy proposal was "inconsistent with the objectives and policies of the Commonwealth Government." Never were truer words said.

"Cooking with gas" might be slang for things going well, but new research from the Climate Council estimates doing it inside the home is responsible for up to 12 per cent of the burden of childhood asthma in Australia.

Asthma Australia chief executive Michele Goldman said better ventilation reduces the risk but does not eliminate it.

The financial benefits of gas at home have also been questioned this week by a detailed report by a Renew: "Affordable Energy Choices for WA Households." The report concludes it is always more economical for a new home to be all-electric, and in most cases, it saves money to replace a gas appliance at the end of its life with an electric one.

UN scientists have warned of the need to curb rising methane emissions driven by increased gas production, livestock and climate change affected wetlands.

Meanwhile, in WA, applications for the Premier's science awards are open.

The categories are Scientist of the Year, Woodside Early Career Scientist of the Year, ExxonMobil Student Scientist of the Year, Shell Aboriginal STEM Student of the Year, and Chevron Science Engagement Initiative of the Year.

Spot the trend in the sponsorships?

Whether you agree or not, most young people hate the fossil fuel industry, and this linkage will only turn them away from science. That is not what Australia needs.

Have a good weekend.

Cheers

Pete