🗡️ Who murdered the Murujuga rock art science?

Special Cluedo™️ edition 🔍 Was it Mr Cook or Prof Smith?

With only one growth option Woodside is selling Scarborough LNG hard, but is it a sensible investment in a world moving to tougher action on climate?

EXCLUSIVE ANALYSIS

"Today you're going to hear a lot about Scarborough," Woodside chief executive Peter Coleman told investment analysts this week, and he was right.

Woodside's annual Investor Briefing Day on Wednesday was a much-needed opportunity to impress a market that now priced the Perth-based LNG specialist's shares at their lowest value for 15 years.

There was a lot to learn behind the buoyant sales pitch.

1. Bye bye North West Shelf

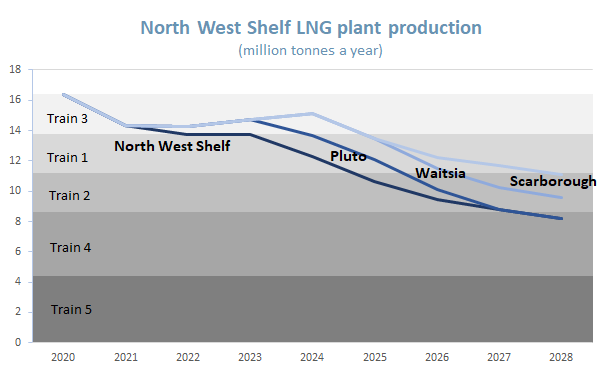

Next year the North West Shelf LNG plant will not be full after 32 years of effort to push as much gas as possible through it each day.

Without gas from elsewhere, such as Pluto, Mitsui and Beach Energy's Waitsia field in the Perth Basin, or later some excess gas from Scarborough the third NWS LNG train will shut down in 2024 after 32 years of service.

Production from the project that made Woodside and was the foundation of WA industry for decades will halve by 2028.

2. Pluto field soon past its best

For 15 years Woodside's 90 per cent share of the 4.9 million tonnes a year Pluto LNG project has been its primary source of revenue, not its 17 per cent slice of the 16.4 mtpa NWS plant down the road.

In six years, Woodside plans to use up the 60 per cent of the original Pluto LNG train capacity for gas from Scarborough.

So, Woodside has decided it is better off producing Scarborough gas it owns 73.5 per cent of than its 90 per cent share of Pluto.

That says a lot about the cost competitiveness of gas from Pluto by mid this decade.

3. Browse dumped

On Valentine's Day, February 2018 Woodside announced it had bought ExxonMobil out of the Scarborough field and assumed operatorship.

Woodside matched up its new Scarborough asset up with three-times-around-the-block Browse.

Scarborough gas would supply an expanded Pluto LNG plant and gas from Browse would flow through 1000km of pipeline to backfill the NWS plant. The two plants on the Burrup Peninsula would exchange gas through an interconnecting pipeline.

The happy couple was called the Burrup Hub.

For two years Woodside consistently pushed the Burrup Hub. On Wednesday, over two hours, the phrase was not mentioned once.

Browse is expensive and dirty. It is a project for the past century.

4. It is all about Scarborough now

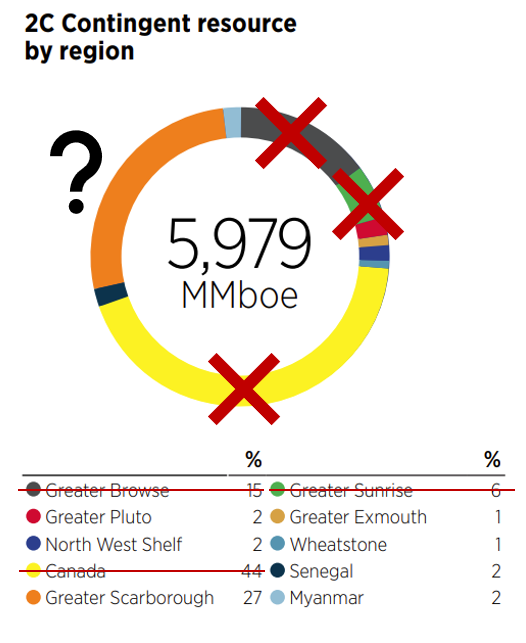

Browse joins Sunrise in the Timor Sea and Kitimat in Canada as Woodside fields that will never be developed.

In the past large gas fields like Chevron's Gorgon could wait for decades and still be produced.

Today, a delay is death as opportunities for large LNG developments in a world belatedly committing to strive for net-zero carbon emissions by 2050.

Browse got a few mentions in front of the investment analysts for politeness, and to distract from the awkward fact that Scarborough is now Woodside's only growth option.

A salesman with one product must sell it hard, and that is what Woodside did, starting with the appeal of LNG in a carbon-constrained world.

5. A selective take on the energy outlook

Woodside used the International Energy Agency's annual World Energy Outlook released in October to bolster its business case.

Woodside senior vice president climate Tom Ridsdill-Smith rightly said that the IEA predicted Asia Pacific gas demand would keep growing to 2040 under its sustainable development scenario where global warming is limited to 1.65℃.

However, more relevant than Asia Pacific gas to the prospects of Scarborough is the outlook for global LNG, as Australia competes with the US and Qatar.

The IEA predicts LNG growth will continue to about 2035 and then flatten out.

In the sustainable scenario "liquefaction capacity existing or under construction today would suffice through to the end of the decade." So, no need for Pluto Train 2.

Woodside's Investor Briefing Day presentation missed these two key points.

Since the IEA work the major buyers of Australian LNG have moved to support limiting global warning to 1.5℃.

China has committed to net zero emissions by 2060, and Japan and Korea want to reach the goal by 2050. This will depress LNG demand further than the IEA forecast, and only the most cost-competitive projects will proceed.

"New gas export projects need to sell gas at a delivered cost of $US6-8 an MMBtu to break even," according to the IEA.

Woodside claims Scarborough can deliver gas at $US6.8 an MMBtu.

MST Marquee analyst Mark Samter queried if this LNG price could be achieved if the oil price returns to Woodside's assumed $US65 a barrel, which is about $10 more than the IEA predicts in its sustainable scenario.

In a world where warming is limited to 1.65℃ LNG prices will be depressed and no new LNG trains are needed this decade.

When they are, Qatar's massive volumes that Woodside presents as delivering LNG at less than $US4.5 MMBtu will be at the front of the queue.

A business case for building Pluto Train 2 this decade is a business case that requires the Paris Agreement goals to be missed and global warming to greatly exceed 1.65℃.

However, expect the PR deluge to convince you otherwise to continue.

6. Scarborough can only go to Pluto

Woodside has unequivocally put to bed the notion it could send Scarborough gas to the emptying NWS plant and avoid building Train 2.

The NWS plant needs heavier hydrocarbon components in its gas supply to provide the refrigerant that cools methane to a liquid. The expense of modifying the ageing NWS plant to process lean Scarborough gas makes building a second LNG train at Pluto the cheapest option.

Only a small tranche of Scarborough gas could be blended with other supply into the NWS (see first figure above).

If the NWS cannot accept the bulk of Scarborough gas and Browse is dead, there is no identified source of gas that could economically send significant volumes of gas to the plant.

All eyes will be on the results of BP's current drilling of ironbark, a gas prospect not far from NWS infrastructure. Until then, it is unclear why any company would buy Chevron's one-sixth share of the NWS for anything but a bargain-basement price.

7. The risks are adding up

With Scarborough its only option, Woodside is doing everything to make it happen.

No buyer for equity in the Scarborough gas field: Woodside will go ahead with its hefty 73.5 per cent stake.

That leaves only infrastructure investors interested in Pluto Train 2: Woodside must derisk the deal to make it attractive.

However, commercial deals do not eliminate risk; they reallocate it. Woodside will need to take much of the risk of construction cost blowouts and shortfalls of volume through the train.

Woodside said it is targeting for much of the construction of Scarborough and Pluto to be costed as a fixed lump sum, in what it terms a "buyers' market."

It is a fine target to have, but the construction companies know that one-shot Woodside needs Scarborough more than they do.

As the final investment decision approaches any change in contractors would cause a massive delay. The contractors will be in a perfect position to push risk back onto Woodside as final terms are agreed.

8. The hot take

Woodside has only one viable long-term growth option: Scarborough.

Its business case is incompatible with limiting global warming.

The serious questions about demand for its product and its price competitiveness show a real possibility for low returns.

Woodside's desperation to make it happen is forcing it to take on more and more risk.

Is a high-risk low-return project what Woodside investors need, just because that is all that Woodside management has?

Main image: Woodside's Perth headquarters Mia Yellagonga. Source: Woodside Energy Ltd.

All the info and a bit of comment on WA energy and climate every Friday