🗡️ Who murdered the Murujuga rock art science?

Special Cluedo™️ edition 🔍 Was it Mr Cook or Prof Smith?

Prospects for LNG are under a shadow if Paris Agreement emissions cuts are pursued, according to the IEA, leaving Woodside and Santos in a very dark place.

Lower prices and lower demand are the future for Australian LNG if the world chases the Paris Agreement goals to limit the damage from climate warming, according to the International Energy Agency.

A search for LNG through the voluminous 464-page World Energy Outlook released by the IEA yesterday reveals a mountain of unwelcome news for Australia’s $48 billion a year LNG export industry.

The IEA analysis, often criticised for favouring fossil fuels, shows that the fortunes of the gas industry and progress to tackle climate change are mutually exclusive.

The oil and gas industry is in its third major downturn in 12 years with little room to cut costs as it did last time.

The IEA estimates that the pandemic caused the net present value of the next 20 years of natural gas production to drop 20 per cent.

Adoption of policies to achieve sustainable development would see the value of the gas producers halve compared to 2019.

The Paris-based agency looked in detail at three different scenarios for the future of the world’s energy system.

A scenario of net-zero emissions by 2050 to limit global warning to 1.5℃ was looked at in less detail.

The stated policies did not include China’s aim to achieve net-zero emissions by 2060 announced three weeks ago.

The IEA’s estimate that the emissions from just present infrastructure operating until the end of its life will increase the global temperature to 1.65℃ above pre-industrial levels highlights the difficulty of reconciling fossil fuel investment with managing climate change.

Oil and coal have a worse outlook than natural gas, but the IEA questioned the blanket characterisation of gas as a “transition fuel.”

A slight decline in natural gas demand to 2040 from advanced economies is predicted under stated policies. Opportunities to displace coal are exhausted, and gas must compete with renewables, efficiency, electrification of end-use demand, and alternative low-carbon gases.

If sustainable development policies are enacted, more emissions are reduced by switching away from gas than from gas replacing coal and oil. Almost a quarter of gas investment in 2040 would go to bio-methane and low-carbon hydrogen.

There is however a robust case for the long-term presence of gas in the energy system, according to the IEA, including high-temperature heat for industry, heat for buildings and seasonal flexibility for power systems.

However, lower volume and lower prices will make some planned investments unviable.

Last year was a record for LNG final investment decisions, driven mainly by Chinese demand.

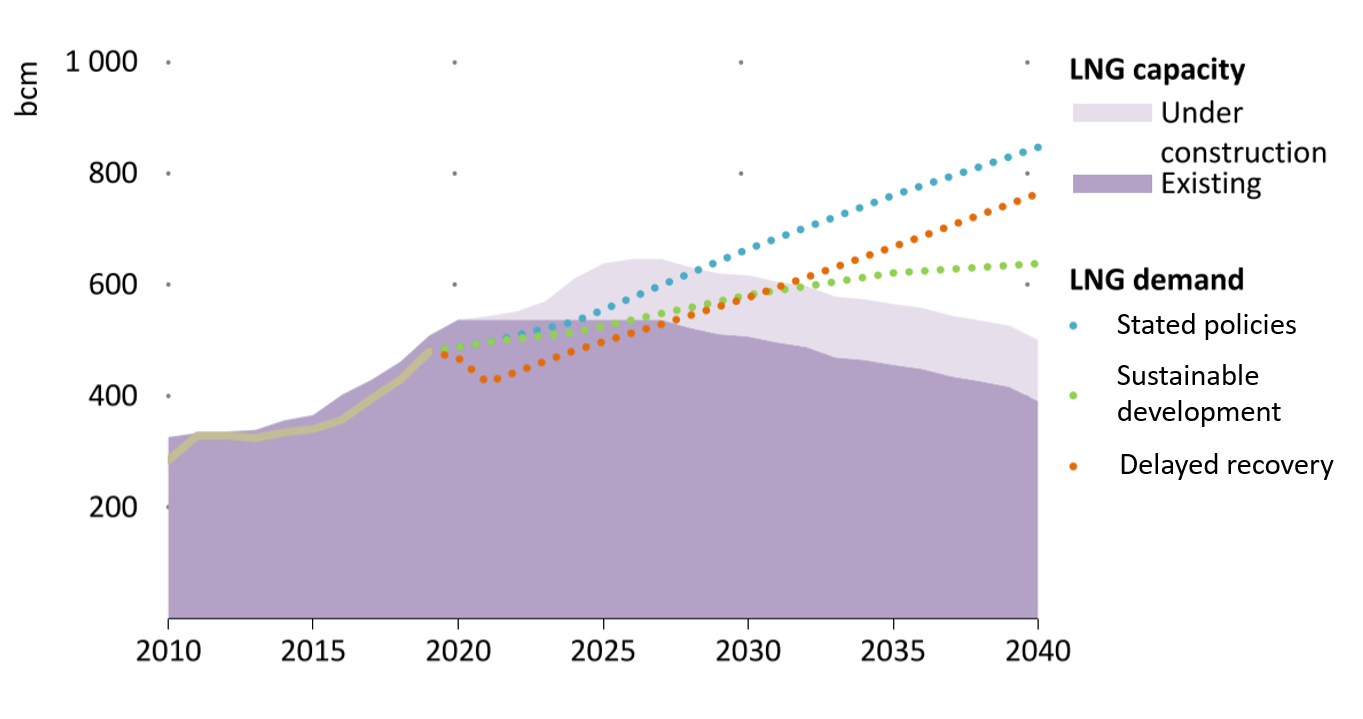

However, the IEA sees no need for more LNG projects until late this decade under stated policies.

If recovery is delayed or sustainable development pursued, there is no need for any LNG projects to be sanctioned until the 2030s.

The IEA estimated that the average gas prices delivered to China and Japan to 2040 to be $US8.5 and $US9.0 a MMBtu respectively under stated policies.

In a world heading toward meeting the Paris Agreement goals, these prices would plunge 27 per cent to $US6.2 for China and drop 38 per cent to $US5.55 for Japan. Lower demand removes the need to develop more costly resources.

“Operators in both Qatar and Russia look well placed to lead long-term supply growth in the post-Covid-19 environment, particularly given their access to vast reserves of low-cost supplies,” the report stated.

The IEA assessment did not allow for China’s recently announced drive for net-zero emission by 2060.

In the short-term LNG economics are most threatened by a delayed recovery but after that “the goals of the Paris Agreement cast the bigger shadow over the prospects for LNG.”

The sustainable development scenario cuts LNG demand in 2040 by 15 to 25 per cent compared to a world that sticks with stated policies and accepts greater damage from climate change.

The IEA believes producers must reduce the carbon intensity of LNG to make a case for gas in the energy transition.

For any LNG projects to go ahead, they will need to be both low cost and low emissions.

The production of a tonne of LNG from Barossa emits about 1.35 tonnes of CO2 and Browse LNG will produce more than 0.9 tonnes on CO2 for each tonne of LNG. All existing Australian offshore LNG project except Ichthys have a carbon intensity of 0.6 or less.

Low cost and low emissions are not what Woodside’s Browse and Santos’s Barossa LNG projects offer.

The IEA assessment describes a narrow rocky path to sanction for these showcase projects from Australia’s two gas giants under current stated policies.

If the world embraces the Paris Agreement that path disappears.

Main image: Northwest Shearwater LNG carrier. Source: BP

All the info and a bit of comment on WA energy and climate every Friday