Alcoa flags 'pretty aggressive' cost cuts at alumina refineries

Alcoa chief executive Bill Oplinger told Wall Street the US aluminium specialist could take strong action to boost profits from alumina, most of which it refines in Western Australia.

Alcoa chief executive Bill Oplinger told Wall Street the US aluminium specialist could take strong action to boost profits from alumina, most of which it refines in Western Australia.

Alcoa chief executive Bill Oplinger has signalled a cost-cutting drive at the company's alumina refineries, which Western Australia - home to the majority of production - would be unlikely to escape.

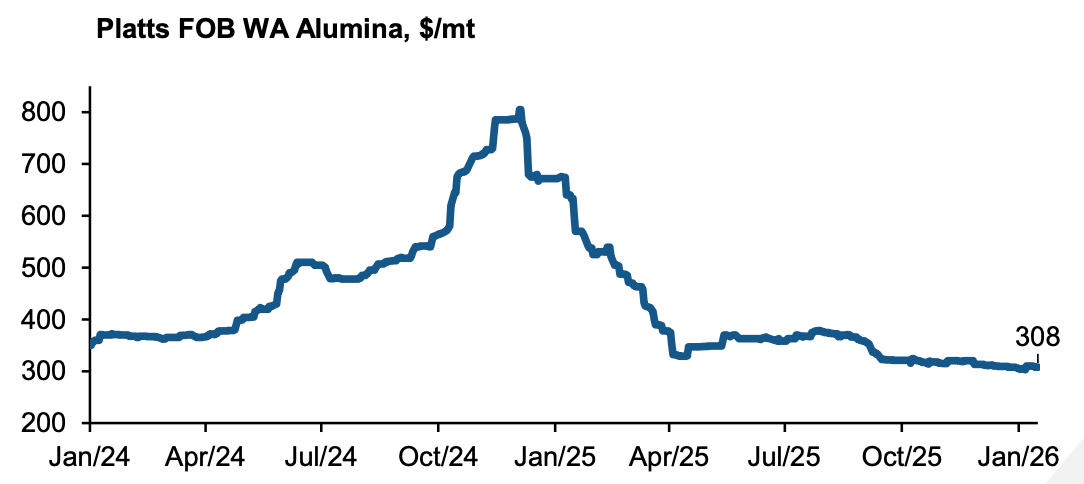

The price the Pittsburgh-based company received for the aluminium smelter feedstock dropped 12 per cent in 2024, cutting earnings from its alumina division by a third.

Alcoa's WA refineries, Pinjarra, Wagerup and Kwinana, which closed in 2024, typically produce more than 70 per cent of the company's alumina.

When queried by Wall Street analysts last week on plans to cut costs and boost efficiency at Alcoa's refineries, Oplinger said that he understood where his alumina division was in the commodity cycle.

'We've shown in the past ... that we can get pretty aggressive around costs," Olplinger said.

However, Oplinger indicated that at least one of his predecessors had gone too far in response to previous low prices.

"What we won't do this time around is really put any of our plants in jeopardy for the future," he said.

Alcoa's WA operations - the Huntly mine that feeds the Pinjarra refinery and the Willowdale mine that supplies the Wagerup refinery further south - employs about 4000 people.

Olpinger was speaking after the $22 billion company released its 2025 financial results that showed a falling financial performance of its alumina business countered by a much better year from its aluminium smelters.

The global prices index for alumina which is based on WA production from Alcoa and South32 fell heavily in the first four months of 2025.

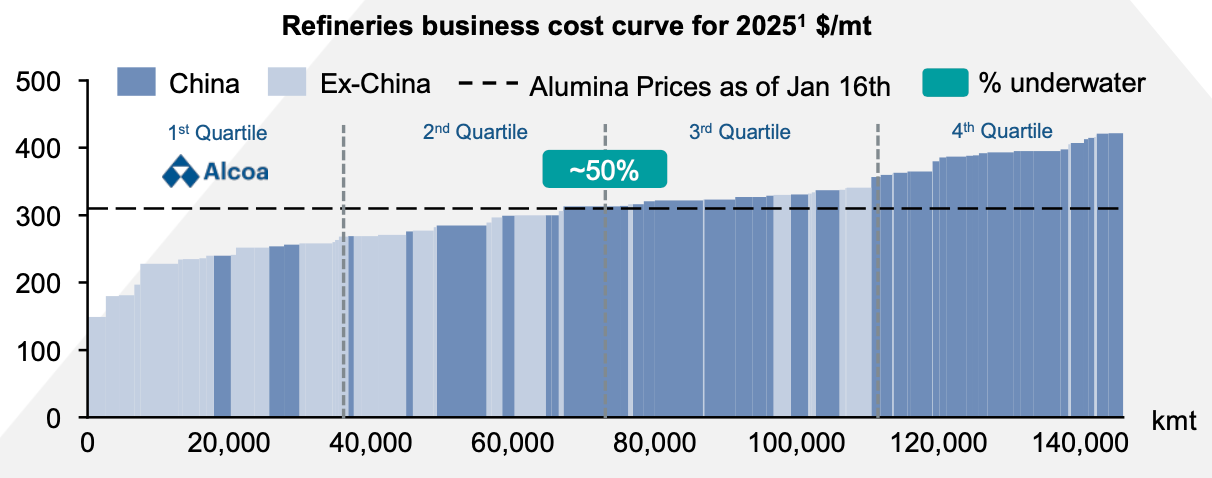

Oplinger said the Chinese government had discouragred large-scale curtailment of production at its refineries despite about 60 per cent of them having difficulties at current pricing.

"Alcoa is exceptionally well positioned to navigate market volatility, thanks to our low-cost mining and refining portfolio and our strong operational performance," Oplinger said.

All of Alcoa's refineries are in the lowest 25 per cent of global production costs.

He praised his teams at WA's Pinjarra and Wagerup alumina refineries for continuing to increase production despite the low bauxite grade Alcoa is currently mining in WA until it gains environmental approval to clear new swathes of jarrah forest.

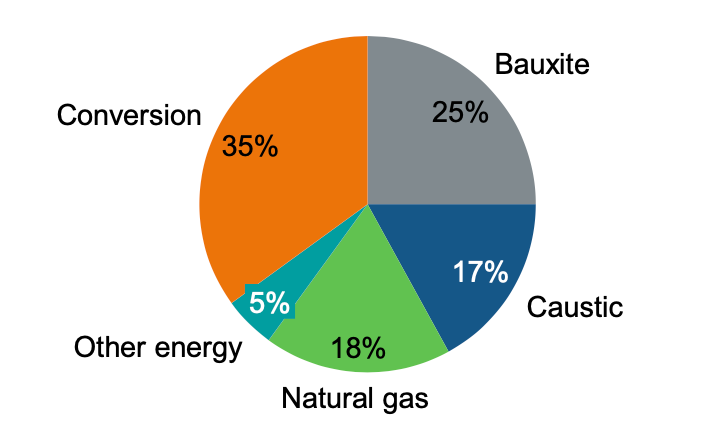

The low grade of bauxite in WA means to produce a tonne of alumina Alcoa needs more ore, more caustic, and more natural gas.

WA's Environmental Protection Authority (EPA) is assessing Alcoa's current mining and a planned expansion of the Huntly mine that is increasingly encroaching of the water catchments that supply Perth.

In January Alcoa provided responses to the EPA to the almost 60,000 submissions the independent watchdog received.

Oplinger said he expected the EPA to publish its recommendations by mid-year and for Alcoa to receive the go-ahead from WA and Federal environment ministers by December.

Read Boilng Cold's breakthrough revelations on how the WA government is doing all it can to put Alcoa before WA's forests and water supply.

Alcoa is betting everything on getting those approvals to continue its six decades of mining WA's jarrah forest that accounts for more than 70 per cent of its bauxite and alumina production.

Oplinger said Alcoa had no plans to develop new mines or refineries.

"Refining capital costs are still fairly high and certainly, at today's prices, it makes it difficult for a greenfield expansion."

However he said Alcoa has opportunities for "brownfield" expansiion of existing mines, refineries and smelters.

To continue mining in WA Alcoa will have to counter concerns about its failure to complete the rehabilitation of a single hectare of forest in six decades and the high chance its mining could contaminate Perth's water supply.

Alcoa Q4 and full year 2025 results

Alcoa Q4 and full year 2025 results presentation

Transcript of Alcoa conference call with investment analysts

All the info and a bit of comment on WA energy, industry and climate every Friday