Five reasons Australia's green hydrogen dream has foundered

Several big green hydrogen projects have been shelved. An expert explains why Australia’s sky-high ambition for the industry is struggling to reach fruition.

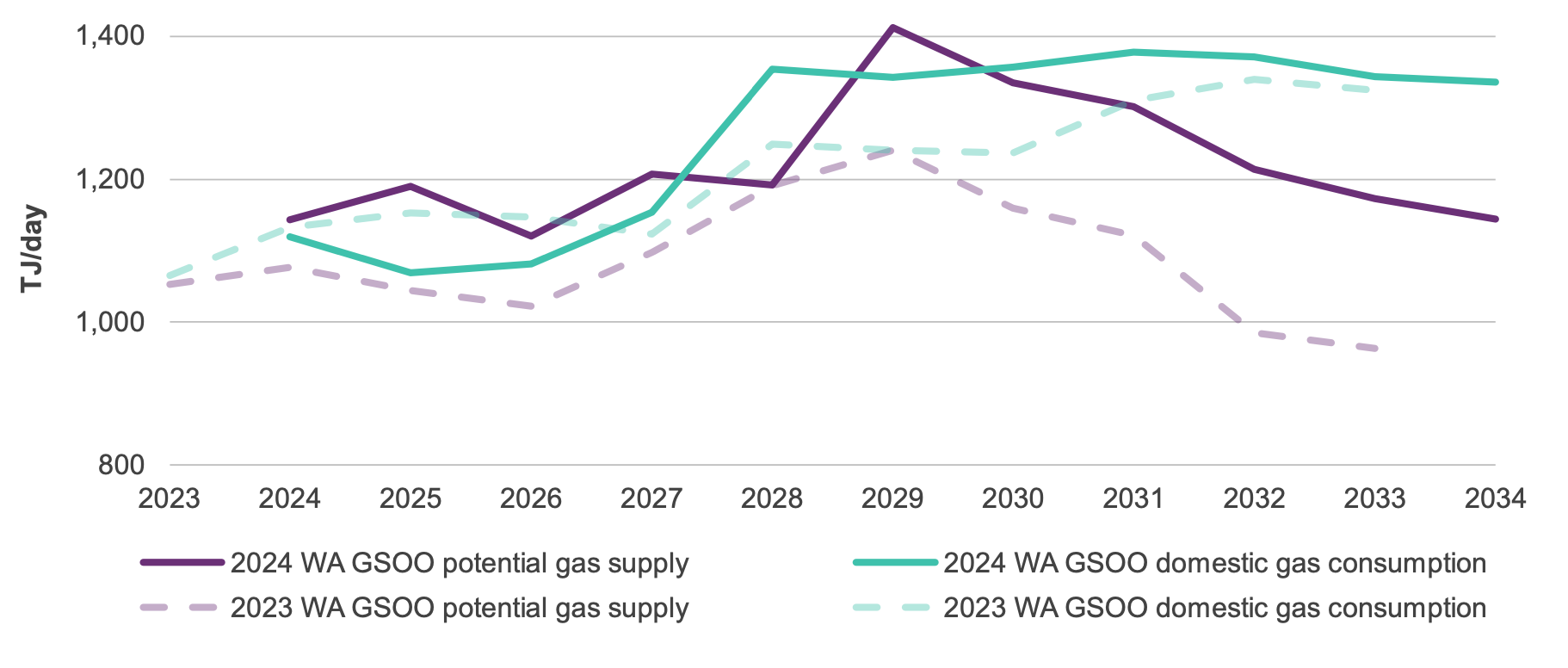

The ten-year forecast stops short of when gas could become very scarce and expensive in Australia's most gas-dependent state.

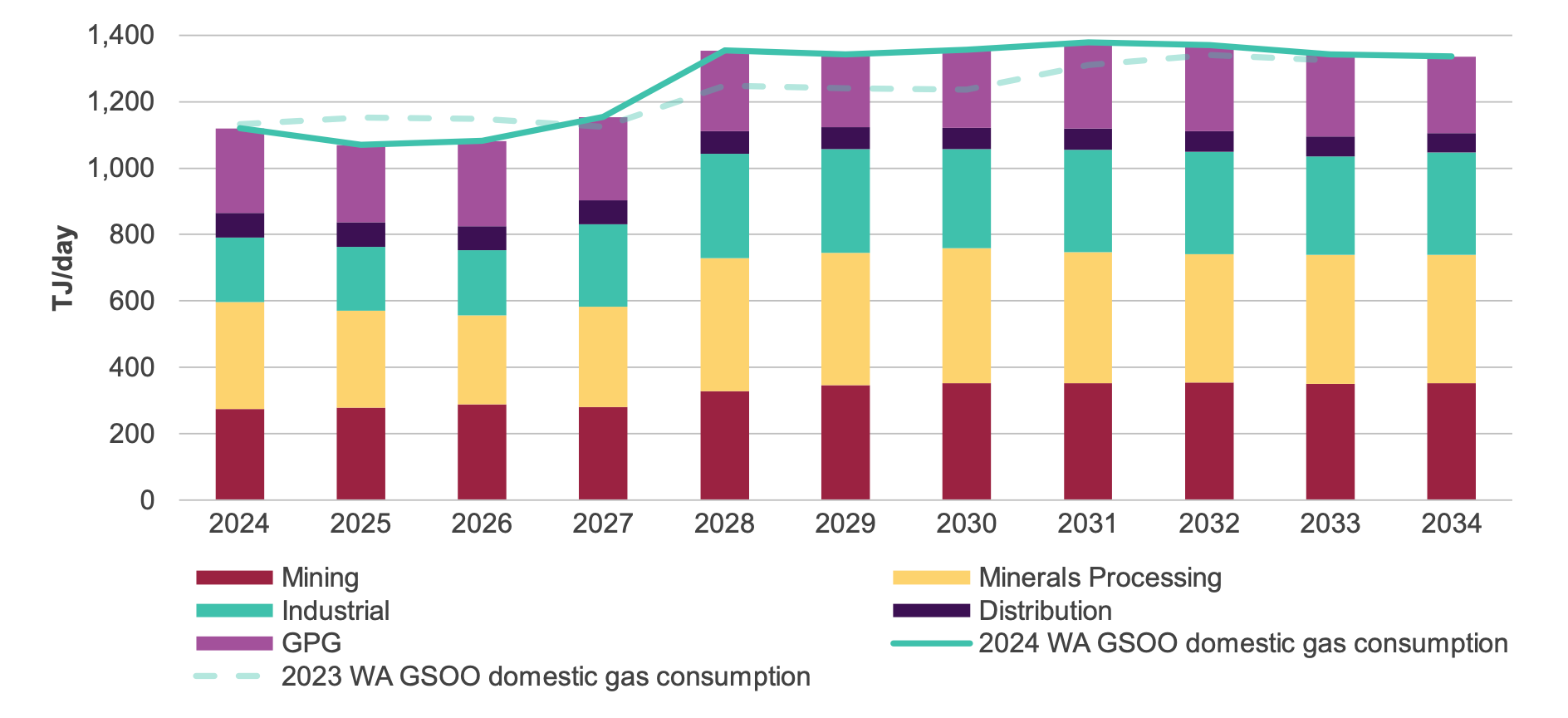

WA's gas supply is forecast to be adequate until 2030 except for a tight 2028 if Alcoa restarts its Kwinana alumina refinery and BHP fires up its shuttered nickel business.

However, from the start of the next decade growing demand from industry and minerals processing will overtake supply from depleting reserves, according to the annual outlook released on Wednesday by the Australian Energy Market Operator

According to AEMO, "The state’s gas supply adequacy is sensitive to the actions of a handful of key players, who in turn are influenced by external factors such as global commodities pricing, energy policy, decarbonisation targets, and the availability of affordable lower-carbon options."

AEMO missed a crucial key player action by not implementing a recommendation from the WA Parliament's inquiry into domestic gas to extend its outlook horizon to 20 years.

"The state’s gas supply adequacy is sensitive to the actions of a handful of key players."

In about 2037, Chevron's Gorgon project—which supplied 26 percent of WA's gas last financial year—will no longer be required to supply the local market.

In 2003 the then Labor state government did not oblige Chevron and its partners Shell and ExxonMobil to supply WA with the equivalent of 15 per cent of their export, but instead agreed a fixed reservation of 2000 petajoules that will be exhausted in about 13 years.

The timeframe may seem distant, it is crucial for considering any long-term investment in WA that would require gas.

Gas will remain an essential element of the power generation system in WA's south-west.

AEMO WA manager Nicola Falcon said that as more renewable generation is added, the use of gas-free power generators (GPG) will become more seasonal. This is driven by summer and winter demand peaks and when output from solar and wind farms drops due to clouds or low wind.

“In future, gas storage is likely to be used more frequently, and we will need more flexibility in daily domestic gas supply to match this increasingly seasonal and peaky gas demand," she said.

A year ago AEMO forecast a supply shortfall in coming years, but increased output from Chevron's Wheatstone and Woodside's NorthWest Shelf and Pluto plants has bridged the gap.

However, most domestic gas plants are now running at capacity, increasing the risk of shortages if there is a supply shortage during times of peak demand.

In early 2023, there were simultaneous problems at Santos's Devil Creek and Varanus Island facilities and Chevron's Wheatstone plant.

AEMO considered what would happen if Bluewaters coal-fired power station closed earlier than the expected date of 2030.

State government financial support for its fuel supplier, Griffin Coal, ends in 2026. If this resulted in Bluewater's shutting down, an extra 27 terajoules of gas a day would be needed for power generation until sufficient new wind and solar generation is bought online and the transmission capacity is built for it to connect to.

All the info and a bit of comment on WA energy and climate every Friday