Alcoa flags 'pretty aggressive' cost cuts at alumina refineries

Alcoa chief executive Bill Oplinger told Wall Street the US aluminium specialist could take strong action to boost profits from alumina, most of which it refines in Western Australia.

SGH's decade of neglect of its Longtom gas field off the Gippsland coast is "an erosion of good industry practice" according to NOPSEMA.

The offshore environment regulator has blasted Seven Group Holdings (SGH) for a decade of subpar performance and a gas well that has leaked off the Gippsland coast for two years.

The interests of soon-to-retire media baron Kerry Stokes and his son, SGH chief executive Ryan Stokes, own 51 per cent of the company.

Last week NOPSEMA ordered SGH to fix a well that has leaked gas at a small rate since at least 2023 and reinstate continuous monitoring of the Longtom wells 30km off the Gippsland coast.

The Longtom field, developed by Nexus Energy, started producing gas from two wells in 2009.

An electrical fault forced the closure of one well in early 2014, and four months later, the troubled company was in administration.

Seven Group bought Nexus in late 2014, only for Longtom production to cease in 2015 after another fault led to the loss of control and communication signals to and from the remaining well.

For the past decade, the asset has sat idle, and according to NOPSEMA, it has been poorly managed by SGH.

NOPSEMA said that Seven leaving the wells unmonitored for a decade without installing equipment to seal them better was “an erosion of good industry practice, a widening gap to established industry standards, and a potential non-compliance” with Federal legislation.

SGH has failed to meet three commitments it made under a plan accepted by the regulator in 2023: fix the leak, visually inspect the wells with a remotely operated vehicle annually, and test the wells' integrity every three years.

NOPSEMA has directed SGH to stop the leak by March 2026, submit a study the next month detailing what is required to make the wells safe, and reinstate continuous monitoring of the wells by October 2027.

An SGH spokesman said it would comply with the three NOPSEMA directions, with actions already underway for all of them.

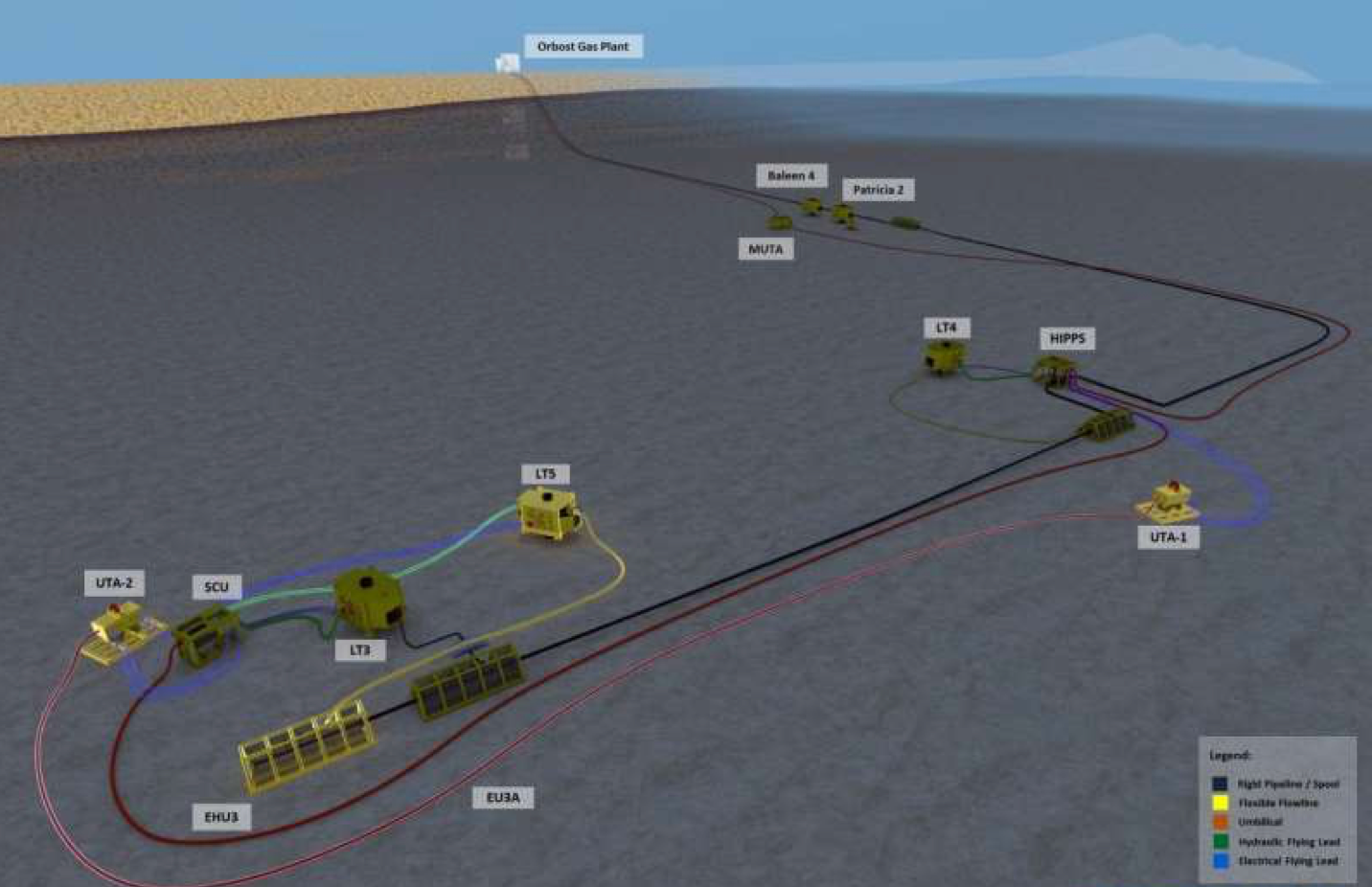

Before it was shut down, gas from the Longtom field flowed through a 17km pipeline to the Patricia Baleen field owned by Amplitude Energy, which is now also shuttered. An Amplitude pipeline carried gas from both fields to the Orbost gas plant in Gippsland.

Longtom’s gas is stranded unless Amplitude Energy, formerly Cooper Energy, restarts Patricia Baleen.

In November, Amplitude chief executive Jane Norman said a feasibility study with Seven was underway, and that Amplitude would decide in early 2026 whether to proceed with front-end engineering.

As Seven doesn’t yet have a binding agreement with Amplitude, which also owns the Orbost plant, it considered whether to impair the $120 million value it assigns to Longtom.

Assuming it could start selling gas at $15 a gigajoule from 2029, SGH concluded no impairment was necessary, according to its 2025 annual report.

However, Seven found that if it did not secure access by 2058, an impairment would likely be required.

SGH has a provision for the eventual decommissioning cost of Longtom, which assumes the pipeline to Patricia Baleen, which would cost $35 million to remove, remains on the seabed.

The company's other oil and gas interests are a 30 per cent stake in ASX-listed Beach Energy and a 15.5 per cent interest in the Crux field. Shell is currently developing Crux to feed gas to its Prelude floating liquefied natural gas vessel off WA's Kimberley coast.

All the info and a bit of comment on WA energy, industry and climate every Friday