🗡️ Who murdered the Murujuga rock art science?

Special Cluedo™️ edition 🔍 Was it Mr Cook or Prof Smith?

A year after Inpex rejected carbon capture and storage at Ichthys LNG as unaffordable it is an essential element in its new drive to slash emissions by 2030.

ANALYSIS

Inpex wants to store CO2 from its Ichthys LNG project underground as it moves to make its business 30 per cent cleaner by 2030 despite a year ago saying it was unaffordable.

Inpex chief executive Takayuki Ueda yesterday announced that the Japanese oil and gas company would achieve net-zero emissions by 2050. As an interim goal, Inpex will cut its emissions per unit of energy it produces by 30 per cent by 2030.

Ueda said the biggest challenge was to make natural gas cleaner, and Ichthys is by far Inpex’s largest gas project.

“This is a gigantic project and…we aim to make the LNG as clean as possible and will engage in carbon capture and storage initiatives,” Ueda said.

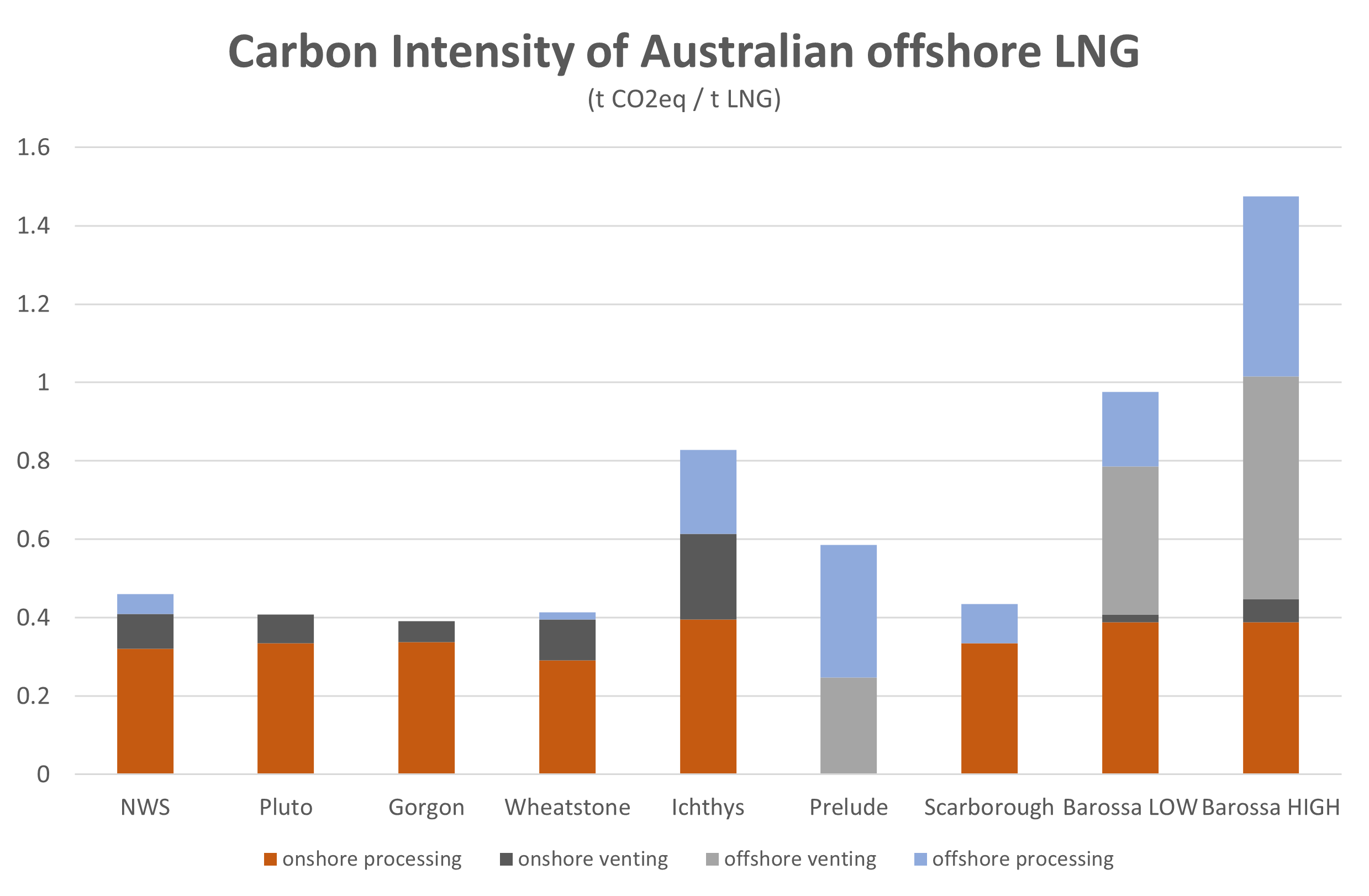

Making Ichthys cleaner is no easy challenge as the $US45 billion ($59 billion) project produces more greenhouse gases per tonne of LNG than any other Australian LNG project fed by offshore gas.

Inpex’s current enthusiasm to use CCS for Ichthys is a complete turnaround from November 2019 continued in a submission to the Productivity Commission.

“To date, Ichthys LNG has spent over $10 million evaluating CCS as an abatement option,” the submission stated.

“While there may be no technical barriers to implementation, the cost of CCS is very high with a break-even carbon price of around $100/t carbon dioxide equivalent or more.

“Therefore, implementation of CCS cannot be commercially justified at this stage.”

Inpex’s aversion to CCS for Ichthys was before Japan’s Government committed to net-zero emissions by 2050 in October.

In 2019 Inpex produced the equivalent of 8.76 million tonnes of CO2, as measured by its equity share of assets.

Inpex’s 66 per cent of Ichthys will produce about 53 per cent of the company’s emissions if the project emits the 6.95 million tonnes of CO2 allowed under the Federal Government’s safeguard mechanism.

Inpex cannot meet its 2030 emissions target without substantial progress at its largest asset, but the pursuit of CCS appears to be at an early stage.

According to a company presentation, Inpex is still investigating the feasibility of burying CO2 from Ichthys and is yet to select an injection site.

Given that Chevron started studying the burial of CO2 from its Gorgon project in 1998 and the system is currently turned down as sand is clogging wells, nine years is a very short time for Inpex to go from early studies to reliable operation.

Boiling Cold understands ENI investigated storing CO2 in the Bayu Undan reservoirs when it was promoting the CO2-rich Evans Shoal field as a replacement supply of gas to the Darwin LNG plant when Bayu Undan is depleted.

Ichthys’ emissions come from gas burnt offshore (26%), reservoir CO2 extracted from the pipeline when it reaches the Ichthys LNG plant near Darwin (35%) and gas burnt to drive the LNG plant (40%).

Like Gorgon, Ichthys would store CO2 in the gas from the Ichthys reservoir as it is already separated as LNG plants cannot process gas containing CO2.

Complete storage of the reservoir CO2 would more than achieve Inpex’s targeted 30 per cent emissions cut.

To store CO2 in the Bayu Undan reservoir, Inpex would need a pipeline from Darwin and the cooperation of the other Bayu Undan partners and the Timor Leste Government.

Inpex has now joined all but one of the big players in Australian offshore LNG that in the past 12 months have adopted significant targets for cutting emissions.

The targets differ in coverage (operational emissions of Scope 1 direct emissions and Scope 2 emissions of electricity purchased, or the inclusion of the Scope 3 emissions from the end use of the product) and whether total emissions or emissions intensity (emissions per unit of energy produced) is measured.

The exception is Chevron that in October 2019 announced a relatively unambitious 5-10% cut in the emissions intensity of oil production and 2-5% for gas production over the period 2016 to 2023.

Inpex’s other Australian LNG investment is a 17.5 per cent interest in Shell’s troubled Prelude floating LNG, the second dirtiest LNG from offshore Australia after Ichthys.

Retrofitting any carbon storage solution to Prelude would be extraordinarily difficult due to lack of space and the cost of offshore work.

However, Ichthys and Prelude's emissions intensities are far less than the Barossa LNG project proposed by Santos to fill Darwin LNG after Bayu Undan.

Most of the 16 to 20 per cent CO2 content in the Barossa reservoir will be vented offshore.

Previous Barossa operator ConocoPhillips had discussed an alternative of bringing all the CO2 to shore in its 2018 project proposal to offshore regulator NOPSEMA, but it was not the base case.

Onshore venting of reservoir CO2 would have allowed Santos to pursue similar CCS options that Inpex is now investigating for its nearby Ichthys LNG plant.

Main image: Ichthys LNG Plant near Darwin. Source: Inpex

All the info and a bit of comment on WA energy and climate every Friday