Five reasons Australia's green hydrogen dream has foundered

Several big green hydrogen projects have been shelved. An expert explains why Australia’s sky-high ambition for the industry is struggling to reach fruition.

There is no shortage of hype about hydrogen. Time will tell what ideas fall by the wayside and which build enduring industries.

This story was originally published in The Australian Pipeliner, July 2020.

It seems Australia is awash with hydrogen buzz. A specialised product few cared about a decade ago is now touted as a replacement for LNG exports and metallurgical coal in steelmaking, a long-term store of renewable energy, and a provider of green fertiliser and climate-friendly fuel for heavy transport.

Hydrogen is a simple molecule powering a slew of new business opportunities that have one thing in common – the need to slash carbon emissions.

Many make the call to electrify everything, backed by a power grid dominated by renewable energy. The trouble is that not everything can be electrified. Electricity is expensive to store for extended periods or to transport long distances. Batteries can store much less energy for a given weight than liquid fuels. Electricity also cannot produce the high-temperatures required for some industrial processes such as steelmaking.

There is also the need for a cleaner way to meet the current annual demand for 70 million tonnes of hydrogen that is predominantly used in oil refining and to produce ammonia and methanol.

Presently about 75 per cent of hydrogen is made from gas, and most of the remainder comes from coal.

A tonne of hydrogen made from natural gas produces 10 tonnes of carbon dioxide and almost twice that if made from coal. Greenhouse gases from hydrogen production are equal to the combined emissions of the United Kingdom and Indonesia. If global warming was not a concern, there would be no driver to expand the application of hydrogen.

At every stage of the hydrogen value chain – production, storage, transport and use – there is a myriad of technical and commercial options.

From computing operating systems in the 1980s Windows became dominant, MacOS a profitable niche player and Amiga disappeared completely. The same array of fates awaits the hydrogen business cases talked about now.

Time, technical progress, regulation and the market will determine the winners and losers.

The production of hydrogen without carbon emissions comes down to two main choices.

The current steam methane reforming technology that splits methane into hydrogen and carbon dioxide can be combined with carbon capture and storage to produce emissions-free blue hydrogen.

The alternative is green hydrogen made in electrolysers powered by renewable energy that produce hydrogen and oxygen from water.

Perth-based Hazer Group has a technology to produce hydrogen from natural gas but also make high-quality graphite instead of emitting carbon dioxide. A demonstration plant will start next year using biogas from a sewerage treatment works in Perth's south.

In the Latrobe Valley, a pilot plant is under development to test the shipment to Japan of hydrogen made from brown coal and a carbon offset for the CO2 emitted is under consideration.

The winning technology will be the cheapest technology.

Currently, blue hydrogen is less expensive than green hydrogen, but the future will be determined by the rate at which technology can drive prices down.

The future cost of blue hydrogen depends on the price of gas and carbon capture and storage. As an established technology steam methane reforming has less potential to achieve substantial improvements

The expected continued decline in the cost of power from wind and solar energy will help the competitiveness of green hydrogen. The big unknown is the cost of electrolysers and their efficiency that currently sits between 60% and 80%. While little improvement in expected on the more established alkaline electrolysis process, the newer polymer electrolyte membrane technology is expected to improve rapidly over the next few years, according to the National Hydrogen Roadmap,

When it comes to commercialisation green hydrogen has the advantage of being more scalable, with the number of solar panels, wind turbines and electrolysers matched to the investment and production required.

Once produced hydrogen can be used here in Australia or exported. The clear prize that ignited Australian interest in hydrogen was a commitment by Japan to making the new fuel a vital part of its cleaner energy mix.

Minister for Energy and Emissions Reduction Angus Taylor recently said the Government was driving towards a hydrogen cost of $2 a kilogram.

"Getting costs down will be key to establishing Australia as a world leader in the hydrogen sector through both domestic uses …to exporting Australian-made hydrogen to our key trading partners, like Japan and Korea," Taylor said.

Unfortunately, transporting hydrogen overseas is not straight forward.

Hydrogen is often compared to LNG in that it can be cooled to a liquid for transport, but the almost 100℃ extra temperature drop makes the process much more expensive.

Methane becomes liquid at -160℃ in a process that consumes about 10% of the gas; but cooling hydrogen to -253℃ loses 25% to 35% of the energy.

The alternative is to incorporate the hydrogen into a larger molecule such as ammonia, that is liquid at -33℃ or so-called liquid organic hydrogen carriers that have similar properties to oil products.

The rationale behind exporting hydrogen to Japan is that as it is smaller and cloudier than Australia, it could not produce enough renewable energy itself to feed its need for hydrogen.

This export business case was recently questioned by Sydney-based Bloomberg New Energy Finance head of industrial decarbonisation Kobad Bhavnagri.

BloombergNEF estimated that while Australia could land green hydrogen into Japan for US$2.81 a kg by 2050, with onshore wind Japan would be able to produce hydrogen for US$1.60 a kg. Australia was uncompetitive as 70 per cent of the cost was for shipping, wiping out its advantage of cheaper renewable energy.

Bhavnagri said countries requiring energy imports are likely to view hydrogen by ship as the worst option.

"This challenges the narrative that Australia can become a hydrogen exporting superpower," he said.

"Instead, Australia could have a competitive advantage using hydrogen onshore, to produce and export value-added products like green steel, fertilisers, ammonia and alumina, instead of just raw commodities."

Whether Australian hydrogen is used here or overseas, there is a dizzying array of potential uses in addition to Bhavnagri's industrial examples.

Number one is heavy or long-distance transport where compressed hydrogen in a tank has a quicker refuelling process and higher energy density than lithium-ion batteries.

While vehicles would most likely use a hydrogen fuel cell that essentially replaces the lithium battery in current electric cars, hydrogen-based fuels such as synthetic methane, methanol and ammonia could power heavier transport.

In particular, there are few low emission alternatives for rail, shipping and aviation.

Hydrogen trains have started operating in Germany. Thay can work on long-distance or less-used routes where electrification is uneconomic.

Hydrogen can also be the feedstock for synthetic jet fuel or power marine engines in the form of ammonia.

Small streams of hydrogen can be mixed into natural gas distribution systems to achieve partial decarbonisation. This is a relatively simple way to build local demand for hydrogen as it scales up.

ATCO has built a clean energy innovation hub in WA to test the use of blended natural gas and green hydrogen produced on-site with common household appliances.

However, so-called green steel, where hydrogen powers the furnace instead of metallurgical coal could be the killer-application for hydrogen in Australia.

BloombergNEF's Bhavnagri said an international transition to green steel would decimate demand for metallurgical coal, one of Australia's most valuable exports.

However, if that green steel is built here, it could utilise Australia's vast sun, wind and iron ore resources to offset the loss of coal income and jobs.

The Grattan Institute recently concluded that the coal mining areas of central Queensland and the Hunter Valley have the right combination of workforce and renewable energy potential to turn Pilbara iron ore into steel. The north-west was regarded as too expensive to operate a labour-intensive steel mill.

Making ammonia in Australia from green hydrogen has attracted interest from some of the world's biggest industrial companies.

In May BP announced a feasibility study into an export scale project near Geraldton in WA targeting a 20,000 tonnes a year pilot plant that could expand to a one million tonnes a year giant consuming 1.5 gigawatts of power.

Norwegian fertiliser manufacturer Yara is looking to produce 28,000 tonnes a year to replace five per cent of the hydrogen used in its Pilbara ammonia plant as a first step towards decarbonisation.

The International Energy Agency noted last year that while hydrogen has had false starts in the past this time could be different.

In the past hydrogen had surged wave of enthusiasm for hydrogen fuel cells for transport.

"What is new today is both the breadth of possibilities for hydrogen use being discussed and the depth of political enthusiasm for those possibilities around the world," the IEA said in its Future of Hydrogen report.

For businesses involved in hydrogen, the coming decade will be one of experimentation and learning.

Money will be lost at times, and some companies will retire hurt. However, with hydrogen the favoured solution for so many decarbonising opportunities, the rewards for the winners will be vast.

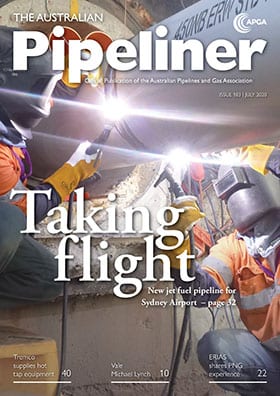

Main Picture: Hydrogen on the table of elements. Source: https://flic.kr/p/AYaVUH

All the info and a bit of comment on WA energy and climate every Friday