🗡️ Who murdered the Murujuga rock art science?

Special Cluedo™️ edition 🔍 Was it Mr Cook or Prof Smith?

BP, unlike Chevron, remains committed to Woodside-operated North West Shelf LNG as it waits to drill nearby Ironbark, but Browse is unlikely to meet its investment criteria.

BP appears to be committed to the North West Shelf for the long term, but not with gas from Browse.

The British major that owns one-sixth of the Woodside-operated NWS intends to cut its oil and gas production by 40 per cent this decade as it pivots from oil and gas to be what it calls an integrated energy company.

BP will sell off oil and gas assets worth $US25 billion off but judging from comments last night its interest in the NWS LNG plant near Karratha and its offshore facilities are not for sale.

BP executive vice president for gas and low carbon energy Dev Sanyal said BP's NWS stake was material to the London-based business and a substantial cash generator. The NWS accounts for about a sixth of the liquefaction capacity BP owns.

"We intend to optimise existing infrastructure through a combination of infill drilling, near-hub exploration and third-party gas," Sanyal said.

US major Chevron has come to a different conclusion and is attempting to sell its own one-sixth stake in the NWS.

Rystad Energy estimated in a presentation today that Chevron's stake is worth $US1.82 billion and listed Woodside, PetroChina and Macquarie as potential buyers.

The North West Shelf partners sanctioned the development of Greater Western Flank Phase 3 in the first quarter of this year, but prospects for future infill drilling are diminishing.

Wood Mackenzie estimates the decline in the NWS project's own gas supply could leave seven million tonnes of LNG capacity unused by 2027.

Only some of this capacity is likely to be used by gas from nearby Pluto or the Waitsia field in the Perth Basin that plans take 1.5 million tonnes of capacity from late 2023.

BP's primary reason to stay in the North West Shelf venture is most likely the "near-hub exploration" opportunity of Ironbark that it plans to start drilling in October and is about 50km from existing NWS infrastructure.

If results from the Ironbark well are disappointing BP could revisit its commitment to the NWS.

Sanyal did not mention BP's 17.3 per cent share of Woodside's Browse LNG project that plans to pipe gas 900km to the NWS facilities.

BP requires gas projects to have a payback period of fewer than 15 years when a carbon price is factored into the project's cashflow. LNG from Browse would require more CO2 emissions for each tonne of LNG than any current Australian LNG project.

It is unlikely that when Sanyal listed "infill drilling, near-hub exploration and third-party gas" as ways to fill the NWS plant with gas he was unaware that Browse, with its 900km pipeline, was excluded.

Sanyal was speaking on the last of three days of presentations by BP management on its new low-carbon strategy.

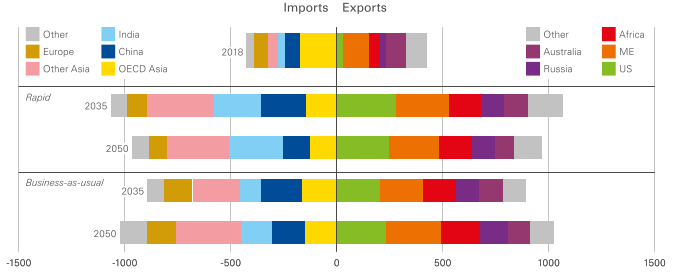

On Monday BP's energy outlook predicted strong growth in global LNG production, with volumes doubling by 2035 whether the world's energy system carries on as usual or if there is rapid decarbonisation to limit the damage from global heating.

In all scenarios, BP predicts the volume of Australian LNG will remain roughly constant, indicating that the future for the industry is to keep existing plants supplied with gas, not building new ones.

Main image: North West Shelf LNG plant. Source: BP PLC.

All the info and a bit of comment on WA energy and climate every Friday