Vessel problems delay Woodside cleanup of oil field near Ningaloo Reef

After numerous safety incidents a McDermott heavy lift vessel left without completing work at Woodside's Stybarrow field.

Crunch time for Australian LNG: True Paris-aligned emissions targets kill demand and ammonia hopes are too small, too late and probably green.

ANALYSIS

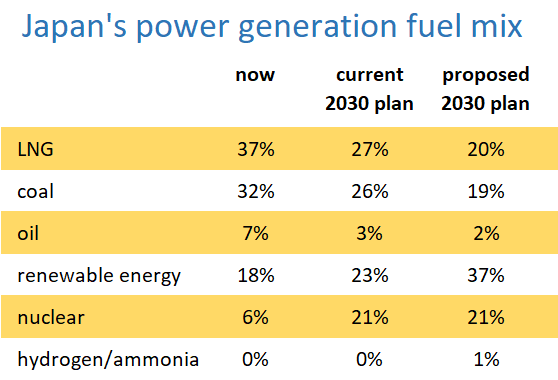

Japan, the foundation customer for Australia's $36 billion a year LNG industry, plans to slash the fuel's share of power generation from 37 per cent in 2019 to 20 per cent in 2030.

The nation's powerful Ministry of Economy, Trade and Industry today issued a draft energy policy that hits gas as hard as coal to meet new emissions reduction targets.

Both fossil fuels lost a seven per cent market share in the revised plan.

The draft supports the Japanese Government's decision in April to cut 2030 emissions by 46 per cent from 2013 levels, up from the earlier 26 per cent target.

The role of gas as a bridge between coal and renewables shrinks when countries adopt more aggressive emissions reductions. Emissions savings between gas and coal are insufficient to meet the targets, and the resultant short period of use cannot justify significant investment in gas infrastructure.

In more bad news for gas incumbents, the tiny one per cent share for hydrogen and ammonia planned for 2030 shows the new fuels cannot save the LNG industry.

Japan plans for renewables to do almost all the decarbonising work this decade, leaving just a small market for hydrogen. Some of that market will be green hydrogen and ammonia produced from renewable energy.

Longer-term, the global hydrogen and ammonia market could become more significant, driven by opportunities such as displacing oil for shipping and coal in steelmaking.

However, in the 2030s green hydrogen is more likely to be cost-competitive against the gas and carbon storage blue alternative.

The gas producers could face a cashflow crisis before then as their current market shrinks well before an alternative market for hydrogen and ammonia has meaningful scale.

Fortunately for Australian LNG exporters, the trade is no longer all about Japan.

China has just overtaken Japan as Australia's biggest LNG customer, taking almost 30 million tonnes in the 12 months to June 2021 compared to 28 million tonnes to Japan, according to an analysis by EnergyQuest.

While China may provide further growth for Australian LNG exports, Japan had two clear advantages for the industry. Japanese buyers are willing to invest in Australian projects, and the Government would never disrupt the trade for political purposes.

A slowing of demand in Japan is likely to prod Qatar, the low-cost giant of LNG, to be more competitive in chasing Chinese contracts.

The future for Australian LNG is looking to be a low margin, high market risk, climate-exposed business. But, unfortunately, investors looking for that set of attributes in their portfolio are thin on the ground.

Less than a week ago, Woodside launched a sale process for equity in its Scarborough gas field and the proposed second LNG train at the Pluto LNG project.

For Woodside in 2021, whether it is chief executive transitions or asset sales, timing has not gone its way.

Main image: Tokyo street scene. Source: Jezael Melgoza on Unsplash

All the info and a bit of comment on WA energy, industry and climate in your inbox every Friday