🗡️ Who murdered the Murujuga rock art science?

Special Cluedo™️ edition 🔍 Was it Mr Cook or Prof Smith?

A $6B high-tech subsea compression system will keep Chevron's Gorgon LNG plant supplied with gas but little of the massive spend will occur in Australia.

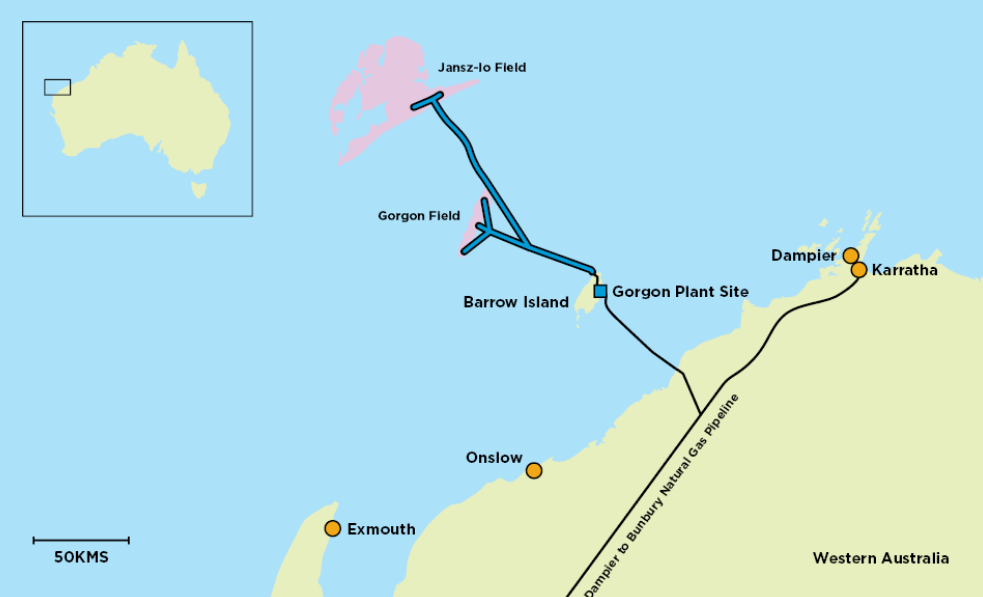

The Gorgon LNG project will spend about $US4 billion ($6 billion) installing gas compressors on the seabed to maintain gas supply from the Jansz-Io field to the LNG plant 135km away. Contrary to the hype, Chevron will spend little of the budget in Australia.

Chevron Eurasia Pacific president Nigel Hearne said the project was Chevron's most significant capital investment in Australia since the Gorgon Stage 2 project in 2018.

The Gorgon LNG project that cost $US54 billion to build was supplied with gas from 18 wells. Like all LNG projects, spending must continue to maintain gas supply to the LNG trains.

The $US4 billion Gorgon Stage 2, nearing completion now, is the drilling and connection of eleven additional wells into the Gorgon and Jansz-Io fields to maintain supply as production reduces pressure in the reservoirs.

As reservoir pressure continues to decline, more wells cannot keep the LNG plant full, so Chevron is installing a compressor on the seabed to pump gas from Jansz-Io to Barrow Island.

Subsea compression was first used on the Asgard field off Norway in 2015.

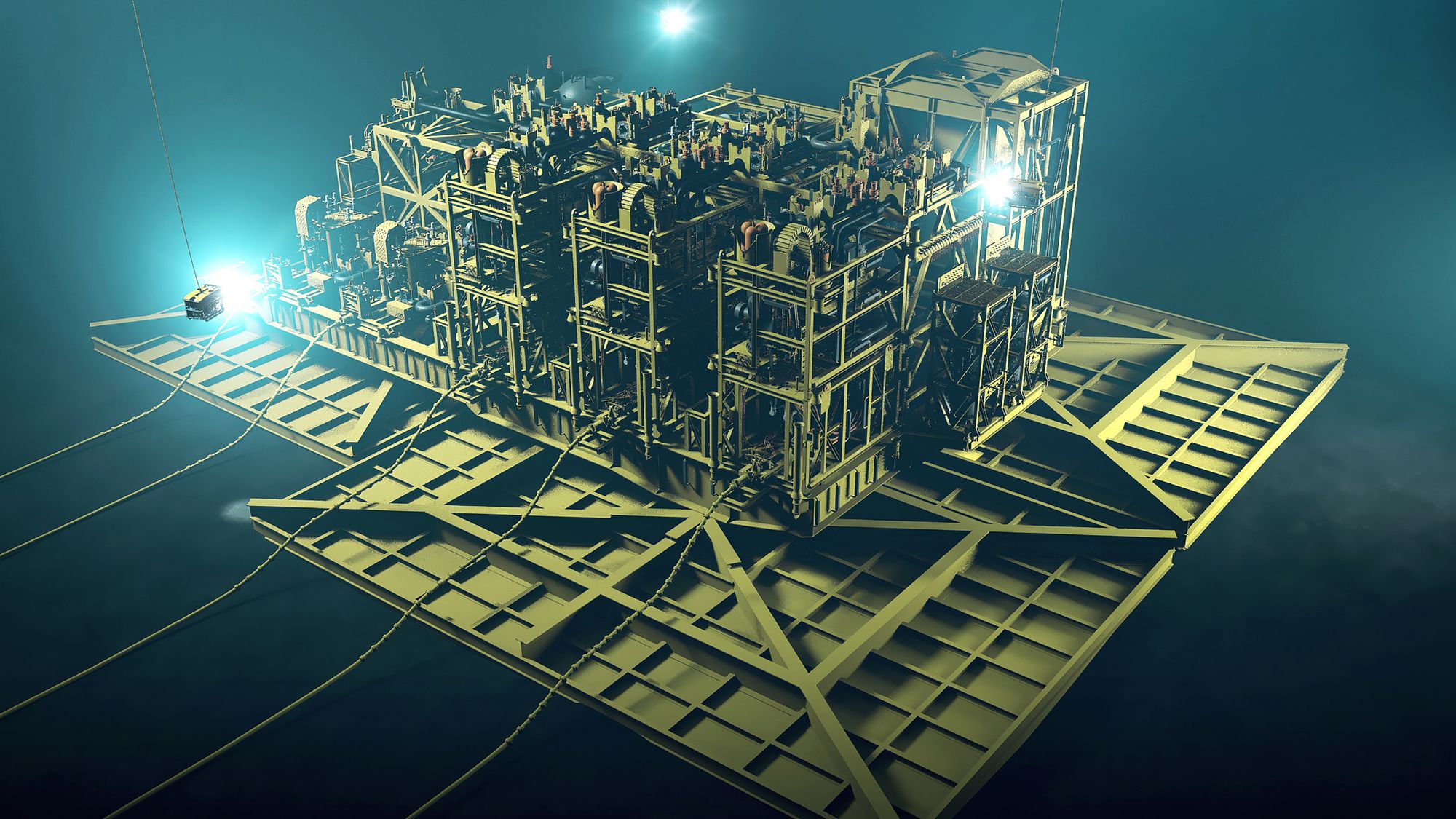

The equipment on the seabed, 260m below the surface of the North Sea, is complicated. The raw gas from the wells is cooled, separated into gas and liquid streams that are compressed and pumped respectively, then the gas is cooled, combined with the liquids and flowed through a 40km pipeline.

Chevron originally planned a manned semi-submersible compression platform that would require the gas to be piped to the surface facility, compressed, and then piped back to the subsea pipeline to Barrow Island.

Boiling Cold understands putting compressors on the seabed with an unmanned field control station floating above offered substantial cost savings to Gorgon's partners.

The project is still massive, and the 6500t subsea facility, 27,000t 93m-square field control station and 135km power cable will take five years to manufacture and install.

Little of the $6 billion budget will be spent in Australia.

Chevron described subsea compression as an emerging technology new to Australia and with limited experience elsewhere in its 2018 Australian Industry Participation plan.

"The J-IC Project will need to leverage this international knowledge and experience," the plan said.

"Due to the complex design specifications and limited global suppliers of specialist components required for the J-IC Project, some components will need to be fabricated and manufactured outside Australia such as subsea electrical equipment, control system, compression modules, process modules and barrier fluid system; as well as subsea umbilicals, offshore (subsea) HV power cables and (as required) gas turbine generation equipment."

Aker that designed and built the original subsea compression for Asgard, will likely build its equipment in Europe. The Norwegian company's contract with Chevron is worth about $US800 million.

Chevron's plan states the floating control station will be built overseas.

The reality is that most work will be done outside Australia.

The low local content, which may be technically and economically justified, was not reflected in the torrent of coordinated but unoriginal public relations that followed today's announcement from Chevron's headquarters in California.

Chevron Australia managing director Mark Hatfield said the project was expected to deliver meaningful contracting opportunities for Australian businesses.

"Meaningful" is not easily quantified.

APPEA WA director Claire Wilkinson also said, "the project is expected to provide meaningful contracting opportunities."

Chamber of Minerals of Energy chief executive Paul Everingham said he knows "Chevron is keen to ensure there will be meaningful contracting opportunities for Australian businesses."

Resources Minister Keith Pitt said the $6 billion spend would create about 350 construction jobs over the five years.

Chevron Jansz-Io compression engineering manager Rob Jones told the AOG Conference in Perth in March that the business case for subsea compression was confirmed in 2014.

Jones said when a concept study started in 2015; many people considered subsea compression to be "too much of a technology step out."

However, Equinor's success at Asgard and later at its Gullfaks field showed the technology worked.

"We're confident it now has the runs on the board to take us forward as a firm basis for reliably supplying gas to the onshore facilities," Jones said.

The principal technology leaps from Asgard that Chevron had to consider carefully were a water depth of 1350m, not 300m and a 30 per cent higher design pressure.

The final 2400m of the power cable that rises from the seabed to the field control station required detailed analysis to avoid fatigue issues common on so-called dynamic risers in the area.

The concept study concluded that subsea compression was cheaper and better in some health and safety areas.

Chevron's chosen option does not have people and hydrocarbons in close proximity, unlike a manned compression platform.

The front end engineering for subsea compression ran from March 2019 to July 2020. Boiling Cold understands the 12-month delay from the end of FEED to FID today was partly driven by concerns from Gorgon partner Shell about the new technology.

Jones said emissions from subsea compression would be significantly less than a compression platform. The project will receive 50MW of power from Barrow Island.

Chevron operates and owns 47 per cent of Gorgon. Shell and ExxonMobil own 25 per cent each, and three Japanese power utilities hold the remaining equity.

Update: July 4 2021: added value of Aker contract.

Main image: Jansz-Io field control station and subsea compression station. Source: Chevron Australia Pty Ltd.

All the info and a bit of comment on WA energy and climate every Friday