🗡️ Who murdered the Murujuga rock art science?

Special Cluedo™️ edition 🔍 Was it Mr Cook or Prof Smith?

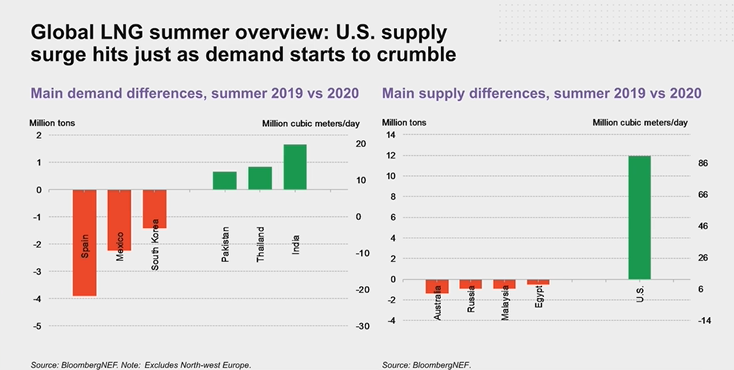

Wood Mackenzie and Bloomberg agree that too much US gas, high stockpiles in Europe and demand hit by COVID-19 make 2020 a tough time for LNG sellers.

LNG producers in 2020 will be crunched by booming US production, stalled or falling demand, and limited opportunity to offload gas to Europe; is the gloomy view from both Wood Mackenzie and Bloomberg.

Bloomberg New Energy Finance head of commodities Ashish Sethia yesterday said the increasingly globalised LNG market had suffered three shocks.

"It was clear in advance that a big increase in US LNG supply was going to hit the global LNG market this (northern) summer,” Sethia said.

Europe that was often a major swing buyer the LNG market had the equivalent 6.6 million tonnes of LNG of additional gas stored than 12 months ago after an extremely mild winter last year, according to BNEF LNG analyst Fauziah Marzuki.

"This is a big factor in reducing the flexibility to absorb the supply glut,” Sethia said.

And, as with all aspects of the economy, the COVID-19 pandemic had upended demand forecasts.

Bloomberg forecast LNG supply will increase by more than 6 million tonnes over the northern summer while demand drops by about 3 million tonnes.

"It's going to be a painful year for suppliers," Marzuki said.

Wood Mackenzie research director Robert Sims today said a turn down in gas production from the US Gulf Coast was the only likely action that could balance the market.

“At a lower $US35 per barrel oil price, we could expect about 2 billion cubic feet per day of US gas production to be impacted by middle of next year,” Sims said.

Gas associated with the production of oil from America’s shale fields may continue to flow even if oil production is curtailed as remaining producers will sell gas they had been flaring, Marzuki said.

Reductions in on-site workforces to reduce the risk from COVID-19 has closed off one option t deal with the oversupply of LNG.

"If the suppliers cannot conduct maintenance during the summer due to health and safety reasons this opportunity to curb supply at a time when prices are low isn't there anymore,” Marzuki said.

Wood Mackenzie predicted more power generation could switch from coal to gas in Japan and South Korea if the oil price that most their LNG imports are linked to remained low, in one piece of positive news for LNG producers.

“We expect Japan’s LNG demand to grow 5.1% to 81 million tonnes in 2020, compared to last year. At the same time, South Korea’s LNG demand is expected to rise 7.7% to 42 million tonnes, as more LNG displaces coal in the power sector of both countries,” Sims said.

Main picture: First cargo departs Wheatstone LNG project in 2017. Source: Chevron Australia Pty Ltd

All the info and a bit of comment on WA energy and climate every Friday